Riding the Energy Wave to the Future

By John Mauldin

“Formula for success: rise early, work hard, strike oil.” – J. Paul Getty

This week’s yuan devaluation was big news, but it’s really part of a much bigger saga. Events around the globe are combining to create huge economic change over the next few years. We are watching giant, multidimensional chess games played by some master players. Energy is the chessboard that connects all the players. What happens when the board changes shape in the middle of the game? If you don’t know the new energy landscape, you’ll have a hard time playing to a draw, much less winning.Today I’ll tell you about some big shifts in the energy industry. These shifts are about as positive as can be, unless you need high oil prices to run your country. In the long run, these changes are bullish for the whole world, which I think this will surprise many of you. And though we’ve been used to thinking about energy and technology as two different facets of modern life, today they are inextricably linked.

When energy changes, everything else changes, too.

16 Candles

Thoughts from the Frontline is now entering its 16th year of continuous weekly publication. I constantly meet readers who have been with me since the beginning – and even some who read an earlier print version of my letters. I put TFTF on the Internet in August 2000 as a free letter, starting with just a few thousand names, and was amazed at how rapidly it grew. It took just a few years for me to realize that this new thing called the Internet was the real deal, and I discontinued my print version. We now push the letter out to almost one million readers each week, and the letter is posted on dozens of websites.

I began to archive the letter in January 2001; and every issue – the good, the bad, and the sometimes very ugly – is still there in the archives, just as I wrote it. I will admit there are a few paragraphs, and maybe even a whole letter or two, that I would like to go back and expunge from the record. But I think it’s better just to let it all be what it is.

Investing in energy without the risk....Here's what our trading par...

I thank you for allowing me to come into your homes and offices each week. I consider it a privilege and honor to be able to offer you my research and thoughts. This letter has been free from the beginning, and my full intent is that it will always remain that way. Longtime readers know the topics can vary widely over the course of the year. I write about what I find interesting that week. I find that writing helps me focus my own thinking.

If you are reading this for the first time, you can go to www.mauldineconomics.com, subscribe by giving us your email address, and join my one million closest friends who get my letter each week. And if you’re a regular reader, why not give me a 16th birthday present and suggest to your friends that they subscribe too! I also want to thank the staff and my partners, who make it possible for me to spend the bulk of my time thinking and writing. And traveling, of course. And now let’s think about energy.

The Cover Pic Indicator

Contrarian and value investors like to buy assets that are in distress, or at least “out of favor.” You don’t hear much about those assets at the time. That’s part of being distressed – everyone ignores you. So, following that logic, the last thing you want to buy is a stock or industry that appears on the cover page of popular financial publications. Commodity and energy bulls should take note of last weekend’s Barron’s cover.

“COMMODITIES: TIME TO BUY,” Barron’s practically screamed at its readers. In case you can’t read the fine print on the cover, it says, The harsh selloff in energy, gold, and other commodities is starting to look like capitulation. Opportunities in Exxon, Chevron, BHP, Goldcorp. Plus six funds and six ETFs to help build a position in this oversold sector.

I presume the photo is supposed to show the sun rising on an oil rig, not setting. The article quotes some very smart people who are bullish on commodities right now. Some energy stocks look like real bargains. Barron’s is simply repeating the market’s conventional wisdom: After a brutal decline, oil prices are stabilizing and should head higher as the global economy recovers.

That’s a perfectly defensible position – but I think it’s wrong.

It’s wrong because it misses a major shift in the way we produce energy. Many people think OPEC’s high oil and gas prices led to the US shale energy boom. That’s not right. The shale boom was born in a time of lower energy prices, and it was the result of new technologies that make recovering large quantities of oil and gas less expensive than ever.

I used to get the occasional letter from James Howard Kunstler, who would tell me that whatever letter I had just written was completely bass-ackwards, and how his books explained that we were going to run out of energy and then collapse. His books (Wikipedia lists about a dozen) and dozens of others warned us of Peak Oil. (For the record, James, a certain longtime editor on my staff made sure I got all your letters, reports, and more, as he is firmly in your camp! I kept smiling and saying that he was (and is) wrong; but Charley is a phenomenal editor, and you put up with a few quirks for brilliant editing that makes you look better. Besides, if the world does come to an end, I can wend my way to his survivalist farm and beg for a job and food, although I’m not exactly sure I’m ready to milk goats. Just for old time’s sake.)

I have written for years that Peak Oil is nonsense. Longtime readers know that I’m a believer in ever-accelerating technological transformation, but I have to admit I did not see the exponential transformation of the drilling business as it is currently unfolding. The changes are truly breathtaking and have gone largely unnoticed.

By now, you probably know about fracking, the technology where drillers pump liquids into a well to “fracture” the ground and release oil and gas deposits. It’s controversial in certain quarters, especially among those who hate anything carbon-related.

Fracking technology is moving forward like all other technologies: very fast. Newer techniques promise to reduce the side effects, at even lower operating costs. Furthermore, fracking is only the beginning of this revolution. The Manhattan Institute recently published an excellent (bordering on brilliant) report by Mark P. Mills, Shale 2.0: Technology and the Coming Big Data Revolution in America.... I highly recommend it.

Mills outlines the way the new technologies are turning this industry on its head. Shale production or “unconventional” production is really a completely new industry.

Here is a short quote: The price and availability of oil (and natural gas) are determined by three interlocking variables: politics, money, and technology. Hydrocarbons have existed in enormous quantities for millennia across the planet. Governments control land access and business freedoms. Access to capital and the nature of fiscal policy are also critical determinants of commerce, especially for capital-intensive industries. But were it not for technology, oil and natural gas would not flow, and the associated growth that these resources fuel would not materialize.

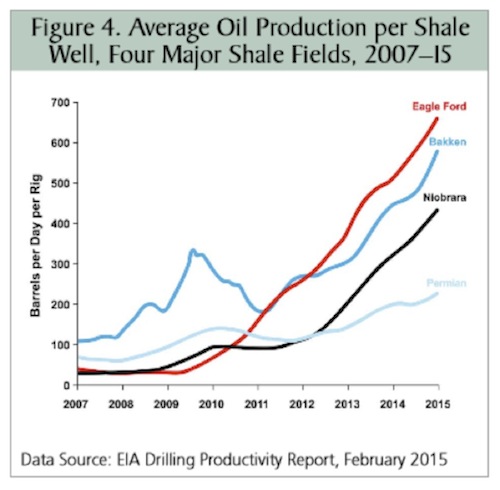

While the conventional and so-called unconventional (i.e., shale) oil industries display clear similarities in basic mechanics and operations – drills, pipes, and pumps – most of the conventional equipment, methods, and materials were not designed or optimized for the new techniques and challenges needed in shale production. By innovatively applying old and new technologies, shale operators propelled a stunningly fast gain in the productivity of shale rigs (Figure 4), with costs per rig stable or declining.

[Look at the above chart for a few moments; it’s truly staggering. In just seven years, the amount of oil per well in some shale plays has risen by a factor of 10! That is almost all due to new technologies that are increasingly coming online.]

Shale companies now produce more oil with two rigs than they did just a few years ago with three rigs, sometimes even spending less overall. At $55 per barrel, at least one of the big players in the Texas Eagle Ford shale reports a 70 percent financial rate of return. If world prices rise slightly, to $65 per barrel, some of the more efficient shale oil operators today would enjoy a higher rate of return than when oil stood at $95 per barrel in 2012.

Read that last paragraph again. Some shale operators can make good money at $55 a barrel. At $65, they can make higher returns than they did three years ago with oil at $95. I have friends here in Dallas who are raising money for wells that can do better than break even at $40 per barrel, although they think $60 is where the new normal will settle out. Texans are nothing if not optimistic.To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best selling author, and Chairman of Mauldin Economics – please click here.

The article Thoughts from the Frontline: Riding the Energy Wave to the Future was originally published at mauldineconomics.com.

Get our latest FREE eBook "Understanding Options"....Just Click Here!

Top Content

Latest Activity

© 2024 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com

You need to be a member of GoMarcellusShale.com to add comments!

Join GoMarcellusShale.com