Chesapeake Energy To Sell Southern Marcellus & Utica Shale Assets

http://www.finanznachrichten.de/nachrichten-2014-10/31705900-chesap...

WASHINGTON (dpa-AFX) - Chesapeake Energy Corp. (CHK) has executed a purchase and sale deal to sell assets in the Southern Marcellus Shale and a portion of the Eastern Utica Shale in West Virginia to Southwestern Energy Co. (SWN) for aggregate proceeds of $5.375 billion. The transaction may close in the fourth quarter of 2014.

Chesapeake would sell nearly 413,000 net acres and about 1,500 wells in Northern West Virginia and Southern Pennsylvania, of which 435 are in the Marcellus and Utica formations, along with related property, plant and equipment. Average net daily production from these properties was around 56,000 barrels of oil equivalent or boe during September, comprising 184,000 Mcf of gas, 20,000 barrels of natural gas liquids and 5,000 barrels of condensate.

As of December 31, 2013, net proved reserves associated with these properties were nearly 221 million barrels of oil equivalent or mmboe.

Pursuant to this transaction, Southwestern would assume a part of Chesapeake's firm transportation and processing capacity commitments. Based on that capacity and expected future commitments, Southwestern's preliminary plans are to start with 4 to 6 rigs in 2015 and increase to 11 rigs by 2017.

In addition, Southwestern Energy anticipates to drill for a minimum of 20 years maintaining that 11-rig pace. By the end of 2017, the reserve mix for the company is estimated to be nearly one third each for the Fayetteville, northeast Marcellus and the newly acquired West Virginia and Pennsylvania properties as compared to the roughly two thirds for the Fayetteville and one third northeast Marcellus today.

Looking ahead, Chesapeake expects full-year production guidance for 2015 to remain in the range of 7-10% growth from 2014 levels adjusted for asset sales.

Tags:

Replies to This Discussion

-

Permalink Reply by S S C on October 17, 2014 at 4:17am

Permalink Reply by S S C on October 17, 2014 at 4:17am -

Why is this good for the landowners involved?

-

Permalink Reply by Frank Walker on October 17, 2014 at 6:38am

Permalink Reply by Frank Walker on October 17, 2014 at 6:38am -

They are no longer leased to Chesapeake. That's a Godsend!

OTOH, if challenged I would have to confess I'm not certain being leased to SW is a lot better.

-

Permalink Reply by S S C on October 17, 2014 at 7:03am

Permalink Reply by S S C on October 17, 2014 at 7:03am -

I understand that. I hope SW will be easier to deal with.

-

Permalink Reply by Ronald Hayhurst on October 17, 2014 at 10:35am

-

Hi Snort Widley, we are a royalty owner under some of these CHK wells. Could you expand your thoughts about SWN and how they treat their royalty owners?

P.S. If this is a good deal, I believe Statoil will exercise their option to buy these assets.

-

Permalink Reply by Snort Widley on October 17, 2014 at 6:20pm

Permalink Reply by Snort Widley on October 17, 2014 at 6:20pm -

We partnered with them in ARK and LA. I never heard any complaints or saw any litigation. If they get past Statoil then they will shift much their Ark resources to this area.

-

Permalink Reply by james david lamm on October 17, 2014 at 6:49am

Permalink Reply by james david lamm on October 17, 2014 at 6:49am -

ssc, I would say congrats to chk share holders after the $10.00 tumble in the past few months. do not see any impact on land owners except for the possibility of an increase in drilling by south west energy in the region.

-

Permalink Reply by Paul Butler on October 17, 2014 at 8:31am

Permalink Reply by Paul Butler on October 17, 2014 at 8:31am -

It's all very good theatre.

I don't like the fact that CHK (or CHK bankers) has, again, made money by doing nothing more than stinking the place up. I'm reminded that the oil business is quite forgiving, that greater fools abound.

It's fun seeing CHK exit the field with their tail between their legs.

What happened boys?

I hope Southwestern isn't just another batch of blowhard Okies with zero talent, but beaucoup blue smoke and mirrors. CHK victimized a large number of people.

Hope springs eternal.

-

Permalink Reply by Jim Litwinowicz on October 17, 2014 at 12:08pm

Permalink Reply by Jim Litwinowicz on October 17, 2014 at 12:08pm -

SW is a solid company that is getting great results in the wells in NE Pa. They have great production and are good at managing costs so their wells are very profitable.

-

Permalink Reply by S S C on October 17, 2014 at 3:11pm

Permalink Reply by S S C on October 17, 2014 at 3:11pm -

Are lawsuits and disputes against CHK still with CHK or will they belong to the new owner of the wells?

-

Permalink Reply by Philip Brutz on October 17, 2014 at 8:10pm

Permalink Reply by Philip Brutz on October 17, 2014 at 8:10pm -

http://seekingalpha.com/article/2571725-will-chesapeake-energy-bene...

Will Chesapeake Energy Benefit From The Recent Asset Sale?

Summary

- Chesapeake Energy recently sold assets in West Virginia to Southwestern Energy for $5.4 billion.

- This sale will mostly reduce its natural gas operations.

- What are the benefits for the company from this sale?

Chesapeake Energy (NYSE:CHK) announced the sale of assets in West Virginia to Southwestern Energy (NYSE:SWN) for $5.375 billion. The market's reaction was very favorable for this move as shares of Chesapeake Energy spiked 17% on the day of this announcement. Is this deal a good move for the company?

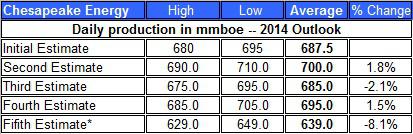

Under this deal, Chesapeake Energy sells 1,500 wells in Northern West Virginia and Southern Pennsylvania. According to the company, out of the 1,500 wells sold, 435 wells are in Marcellus and Utica shale formations. This sale includes related property and equipment. As of last month, the average daily output of these assets is 56,000 barrels of oil equivalent: 184 MMcf of natural gas, 20,000 barrels of NGL and 5,000 barrels of condensate. Considering the company estimated its daily output at 695 Mboe for 2014, the recent sale may bring down its daily output to 639 Mboe for the rest of the year - an 8% drop from the previous annual guidance. The table below shows the changes in the annual guidance during the year.

Source of data: Chesapeake Energy

The newest update is only a rough estimate for the rest of the fourth quarter of 2014. Nonetheless, the company's CEO still expects the company to expand its production by 7%-10% in 2015.

This transaction will bring down the company's dependency in natural gas and natural gas liquids, which are likely to present lower profit margins than oil. After all, nearly 55% of the output is natural gas and 92% consists of natural gas and NGL. As such, this could improve the company's bottom line. One of the reasons is the low realized price of natural gas.

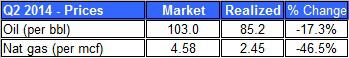

Earlier this year, the price of natural gas spiked to its highest level in recent years on account of lower than normal temperatures and harsh winter conditions throughout the U.S. Despite the high market price of natural gas, the company wasn't able to translate these high market prices to greater earnings due to "basis discounts" to the Henry Hub at delivery points and its hedging structure of natural gas. The table below shows the gap between market and realized prices in the second quarter.

Source of data: Chesapeake Energy

As you can see, the company's realized natural gas price was nearly half the average quarterly price. And even though oil prices fell in the past few weeks, they are still well above $80, which is likely to keep oil more profitable than natural gas.

This recent sale is part of the company's scheme to sell off or swap certain assets and restructure its balance sheet as it did in the past couple of years. Among the company's latest decisions in these lines are: Selling three assets in Southwestern Oklahoma, East Texas and South Texas for $310 million, completing a spinoff of its subsidiary Chesapeake Oilfield Operating to its shareholders - this move was estimated to reduce $1.1 billion from Chesapeake Energy's debt, entering an agreement with RKI Exploration & Production to swap lands in the Powder River Basin, divesting CHK Cleveland Tonkawa in order to slash its debt by $160 million and erase $1 billion of equity attributable to third parties.

This recent transaction will bring in significant funds to the company that could be allocated toward funding its capital expenditures, reducing debt and rolling some of these funds back to its investors with dividends and buybacks. Another point to consider: Up to the second quarter, the company's debt-to-equity ratio was around 0.71, which isn't too high for the industry, but this recent deal could reduce its debt burden.

Chesapeake Energy is likely to benefit from this sale by improving its bottom line and reducing its debt burden. For more: Is Chesapeake Energy's NGL Strategy Right?

- ‹ Previous

- 1

- 2

- 3

- Next ›

Top Content

Latest Activity

- Top News

- ·

- Everything

© 2024 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com