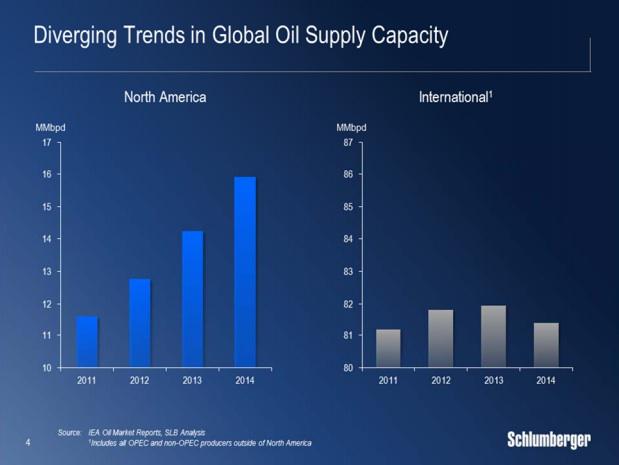

NEW YORK (AP) — The U.S. has so much crude that it is running out of places to put it, and that could drive oil and gasoline prices even lower in the coming months.

For the past seven weeks, the United States has been producing and importing an average of 1 million more barrels of oil every day than it is consuming. That extra crude is flowing into storage tanks, especially at the country's main trading hub in Cushing, Oklahoma, pushing U.S. supplies to their highest point in at least 80 years, the Energy Department reported last week.

If this keeps up, storage tanks could approach their operational limits, known in the industry as "tank tops," by mid-April and send the price of crude — and probably gasoline, too — plummeting.

"The fact of the matter is we are running out of storage capacity in the U.S.," Ed Morse, head of commodities research at Citibank, said at a recent symposium at the Council on Foreign Relations in New York.

Morse has suggested oil could fall all the way to $20 a barrel from the current $50. At that rock-bottom price, oil companies, faced with mounting losses, would stop pumping oil until the glut eased. Gasoline prices would fall along with crude, though lower refinery production, because of seasonal factors and unexpected outages, could prevent a sharp decline.

The national average price of gasoline is $2.44 a gallon. That's $1.02 cheaper than last year at this time, but up 37 cents over the past month.

Other analysts agree that crude is poised to fall sharply — if not all the way to $20 — because it continues to flood into storage for a number of reasons:

— U.S. oil production continues to rise. Companies are cutting back on new drilling, but that won't reduce supplies until later this year.

— The new oil being produced is light, sweet crude, which is a type many U.S. refineries are not designed to process. Oil companies can't just get rid of it by sending it abroad, because crude exports are restricted by federal law.

— Foreign oil continues to flow into the U.S., both because of economic weakness in other countries and to feed refineries designed to process heavy, sour crude.

— This is the slowest time of year for gasoline demand, so refiners typically reduce or stop production to perform maintenance. As refiners process less crude, supplies build up.

— Oil investors are making money buying and storing oil because of the difference between the current price of oil and the price for delivery in far-off months. An investor can buy oil at $50 today and enter into a contract to sell it for $59 in December, locking in a profit even after paying for storage during those months.

The delivery point for most of the oil traded in the U.S. is Cushing, a city of about 8,000 people halfway between Oklahoma City and Tulsa at an intersection of several pipelines. The city is dotted with tanks that can, in theory, hold 85 million barrels of oil, according to the Energy Department, though some of those tanks are used for blending or feeding pipelines, not for storing oil.

The market data provider Genscape, which flies helicopters equipped with infrared cameras and other technology over Cushing twice a week to measure storage levels, estimates Cushing is two-thirds full.

Hillary Stevenson, who manages storage, pipeline and refinery monitoring for Genscape, says Cushing could be full by mid-April. Supplies are increasing at "the highest rate we have ever seen at Cushing," she says.

Full tanks — or super-low prices — are not a sure thing. New storage is under construction at Cushing, and there are large storage terminals near Houston, in St. James, Louisiana, and elsewhere around the country that will probably begin to take in more oil as prices fall far enough to cover the cost of transporting the oil.

Also, drillers are cutting back fast because oil prices have plummeted from $107 a barrel in June. And demand is showing signs of rising.

While the Energy Department reported another enormous rise in crude stocks last week, up 8.4 million barrels from the week earlier, it also reported that diesel and gasoline supplies fell more than expected. That leads some to conclude that demand for crude will soon pick up, easing the surplus somewhat.

But many analysts believe oil prices will fall through the spring, before summer drivers start to relieve the glut.

___

Jonathan Fahey can be reached at http://twitter.com/JonathanFahey .