Current State of Magnum Hunter

Starting this thread to post info related to Magnum Hunter and its various business components. First post is Triad Hunter opening office in Marietta, Ohio. Definately Magnum Hunter is spending in Monroe, Noble and Washington counties in Ohio as well as Tyler and other WV counties.

http://www.mariettatimes.com/page/content.detail/id/549789/Triad-op...

Tags:

Replies to This Discussion

-

Permalink Reply by Philip Brutz on January 27, 2015 at 10:15am

Permalink Reply by Philip Brutz on January 27, 2015 at 10:15am -

http://seekingalpha.com/article/2852886-magnum-hunter-resources-wil...

Magnum Hunter Resources - Will Management Finally Deliver?

Disclosure: The author is long MHR.

Summary- Magnum Hunter Resources' stock price has crashed down to multi year lows along with oil and natural gas.

- Production is ramping up in their Marcellus & Utica assets - recent updates confirm positives on many key deliverables.

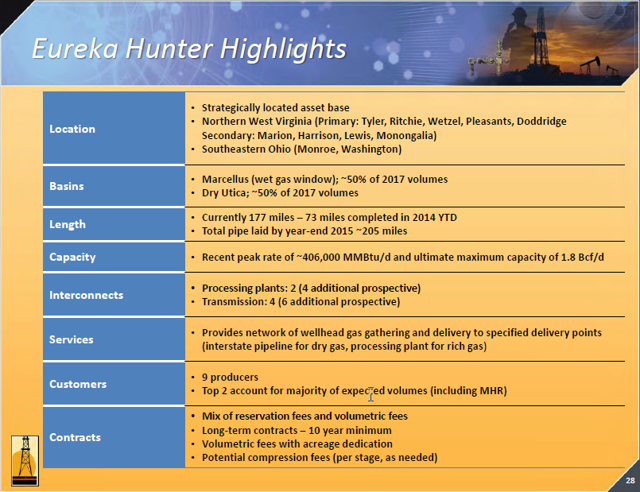

- Eureka Hunter Pipeline assets continue to increase transport volumes & capacity as they move closer to IPO a MLP with Morgan Stanley Infrastructure as key partner.

- Market negatives may have found the bottom this past week and represent a key entry point for significant returns.

Investors have been patiently waiting (some not so much) for the day that Magnum Hunter Resources' (NYSE:MHR) management predictions and commitments come to fruition, and with it the promise of finally reaping the benefits of that patience - a $10+ buyout offer. Just as many of the key deliverables become apparent in management communications, the market for oil and natural gas has collapsed. All is not lost, at least according to Topeka Capital. Topeka Capital analyst Gabriele Sorbara in a research note named his top E&P picks for 2015 as well as a list of the most likely takeout candidates. Takeout targets include Diamondback Energy (NASDAQ:FANG), Laredo Petroleum (NYSE:LPI), Magnum Hunter Resources, Oasis Petroleum (NYSE:OAS), and Rosetta Resources (NASDAQ:ROSE)."While natural gas prices have come off significantly on the milder weather and forecasts....the most likely corporate takeout candidates in our coverage include: FANG, LPI, MHR, OAS and ROSE - all of which would require significant premiums from currently depressed levels."

(Source: Yahoo Finance)

All but one of the referenced companies have seen their fortunes crash in the last three months with the decline in oil and natural gas prices - but Magnum Hunter has a few variables that are haunting the management team and recommending analysts, alike.

This article looks at the current status of management's commitments and the potential for a midterm turnaround in the stock price for investors.

Management Direction - Empty Promises or Committed Deliverables?

The last two years have been a round trip to disappointment for long-term investors - from $4.28 to a high of $9.18 in early 2014 and then to close this last week at $1.93.

(Source: Yahoo Finance)

Two years ago, Magnum Hunter management was under the gun as the focus quickly shifted from growing production to defending itself from lawsuits claiming they had fired their financial auditors, PricewaterhouseCoopers ((PWC)), because SEC reporting requirements were not filed on time. Rumors swirled regarding the financial stability of the company, and the possibility of reserves having been misstated. A month or so later, BDO Seidman had taken the auditor role and proved the issue to be resolved - and the analysts again focused on the quality of the assets, financial liquidity, and the growth of production. By February 2014, the share price hit a high of $9.18, and then fluctuated between $9.00 and $7.00 for a couple of months until it began its descent to its recent lows.

So What Started this Slide?

Management commitments and guidance had begun to sound like the same promises undelivered again and again - production delays, slow growth in reserves, and continued sales of producing oil assets just to fund operations and make required preferred dividend payments. Just as quickly as investment firm Relational Investors had taken a significant position in Magnum Hunter in May 2014, issues within the firm led to a change of direction by October 1. As reported by the Wall Street Journal:

Activist investor Relational Investors "plans to wind down its operations and dissolve its current funds by the end of next year. A new fund with the same name is expected to be eventually launched, but founders Ralph Whitworth and David Batchelder "will cede day-to-day control."

This added questions for investors as to how the shares owned by Relational Investors would affect the market price. Even though the price per share was just above $5, the slide continued.

Since then oil is off more than 40% and natural gas is down more than 25%. Add to that a blowout on a major well, the Stalder Pad in eastern Ohio. That well had been anticipated to contribute to year-end production numbers but it was confirmed that it would not add to production until sometime in 2015.

Management Action Offers Hope to Investors

In early January 2015, management communicated updates on many aspects of performance:

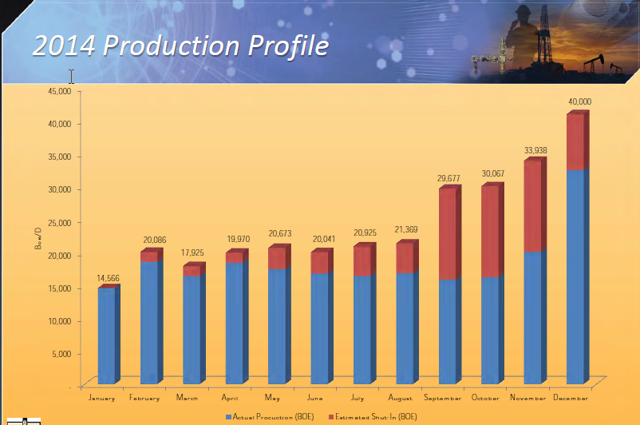

· Production ending the year around 32,500 MBOE/day

· Record throughput of over 406,000 MBTU/day

· Eureka Hunter IPO moving forward for H1 2015

· Reserves at YE 2014 of 83.8 MMBOE

· Secured greater financing to bridge low prices

(Source: Magnum Hunter Resources Jan 2015 Presentation)

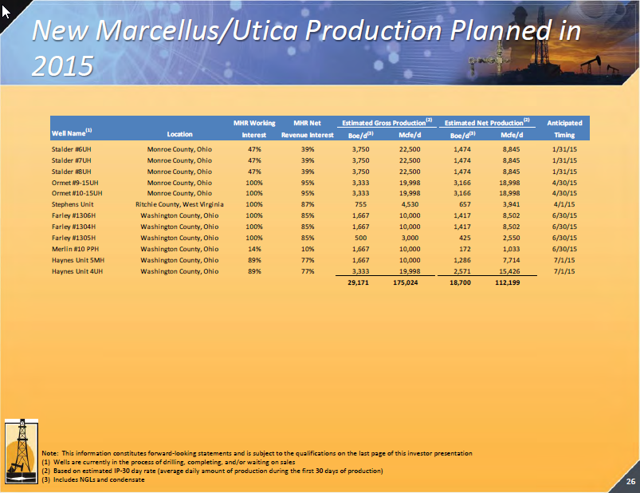

The communication included estimates of production increases in the first half of 2015 beginning in late January.

(Source: Magnum Hunter Resources Jan 2015 Presentation)

Most of these wells will come online with minimal additional capital investment. CEO Gary Evans estimated material growth in 2015 with a capital budget of $100 million, or less than 25% of the budget of 2014.

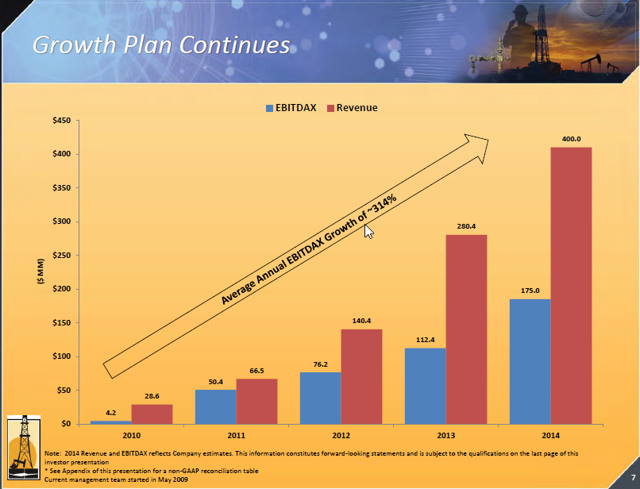

Revenues will continue to grow with the expansion of production of nat gas and throughput of gas through Eureka Hunter pipelines.

(Source: Magnum Hunter Resources Jan 2015 Presentation)

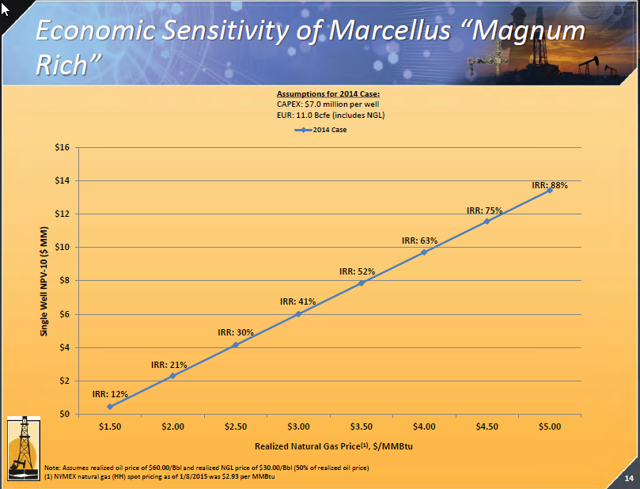

The growth in revenue reflects increases in both nat gas sales and transportation. The midstream assets have really increased the ability to capitalize on the developed assets. The unfortunate turn of pricing in the nat gas market highlights how the sweet success of growing production in the United States is soured by temporary gluts in inventory. However, as reaffirmed by Magnum Hunter's CEO, they are able to produce profitably. The chart below demonstrates they are able to deliver a 40% IRR at current market prices.

(Source: Magnum Hunter Resources Jan 2015 Presentation)

Eureka Hunter Holds the Key

"A combination of Magnum Hunter/Triad volumes from new pads recently put on production as well as new third party volumes contributed to new record throughput volume handled at Eureka Hunter. Based upon projections of additional Marcellus and Utica pads coming on line this month, Eureka Hunter should set another record exceeding 500,000 MMBtu per day (approximately 1/2 BCF) by the end of January. With the continued expansion of new interconnects to other third party pipelines, with a current goal of ten, we believe that Eureka Hunter is uniquely positioned to offer the greatest optionality to all producers in the Marcellus/Utica shale plays for moving both wet and dry natural gas out of the region."

Who Might Want to Buy out Magnum Hunter?

(Source: Magnum Hunter Resources Jan 2015 Presentation)

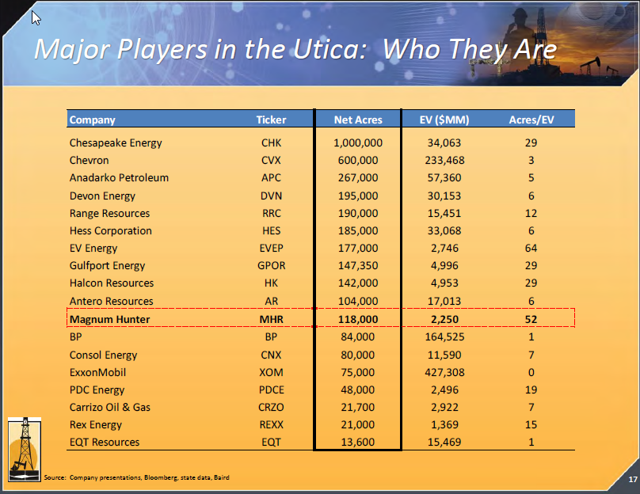

On the other hand, there are many that would be willing to extend their investments in the region to complement the midstream access that Magnum Hunter uniquely possesses. Cabot Oil & Gas (NYSE:COG), Williams Companies (NYSE:WMB) & Chesapeake Energy (NYSE:CHK), Antero Resources Corporation (NYSE:AR), and Range Resources Corporation (NYSE:RRC) all share the common objective to improve their pipeline infrastructure to get their growing production to better priced markets.

Just recently Southwestern Energy (NYSE:SWN) has been expanding significantly in the Marcellus/Utica Shale, as highlighted previously. Their recognition of value in acquisition of both production and midstream assets demonstrates some companies are not wanting to wait to see what happens - they are working to quickly capture the most logical purchases that will provide high yield assets with production that can get to market.

Investors' Takeaway

While Magnum Hunter Resources' stock price may be low, the fundamental benefits of the company's asset base are finally showing promise. The recent low price per share does offer significant upside to the investor even in the short run, as any positive factors can have a meaningful impact on the price. Management's call on Friday helped reaffirm analyst and investors, with the price closing up by 17%. Investors should examine the potential opportunity and level of risk they are willing to accept - Magnum Hunter is definitely beginning to show signs that this could be the last time to initiate a position at prices this low.

There are many companies operating in the Marcellus & Utica shale that would have significant interest in the quality "rock" and midstream assets that Magnum Hunter possesses. As you can see in the listing below, there is a mix of competitors who would like to have the additional reserves; however, not all of those having a presence in the region have the financial capacity or desire to grow at this time.

The jewel of the company's strategy is the Eureka Hunter midstream assets. Its value became very clear in September 2014 that others see the value of this midstream asset - Morgan Stanley Infrastructure (MSI) with the purchase of approximately 41% of Eureka Hunter from Arclight Capital Partners. Total terms of the agreement bodes well for Magnum Hunter in that MSI will provide additional capital funding to grow the pipeline assets, and allow Magnum Hunter to focus capital on the production of nat gas. The implied value of Eureka Hunter is $1 billion - one can only assume that MSI sees the opportunity to grow this value and get a material return on their investment!

(Source: Magnum Hunter Resources Jan 2015 Presentation)

On Jan 7th 2015, Mr. Gary C. Evans, Chairman of the Board and Chief Executive Officer of Magnum Hunter and Eureka Hunter Pipeline, LLC.commented:

"A combination of Magnum Hunter/Triad volumes from new pads recently put on production as well as new third party volumes contributed to this new record throughput volume handled at Eureka Hunter. Based upon projections of additional Marcellus and Utica pads coming on line this month, Eureka Hunter should set another record exceeding 500,000 MMBtu per day (approximately 1/2 BCF) by the end of January. With the continued expansion of new interconnects to other third party pipelines, with a current goal of ten, we believe that Eureka Hunter is uniquely positioned to offer the greatest optionality to all producers in the Marcellus/Utica shale plays for moving both wet and dry natural gas out of the region."

-

Permalink Reply by Philip Brutz on April 16, 2015 at 12:05pm

Permalink Reply by Philip Brutz on April 16, 2015 at 12:05pm -

Dallas Salazar

IPOs, contrarian, long/short equity, long-term horizonMagnum Hunter: Caught In A Viscous Cycle

Apr. 15, 2015 5:47 PM ET | About: Magnum Hunter Resources Corporation (MHR)Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

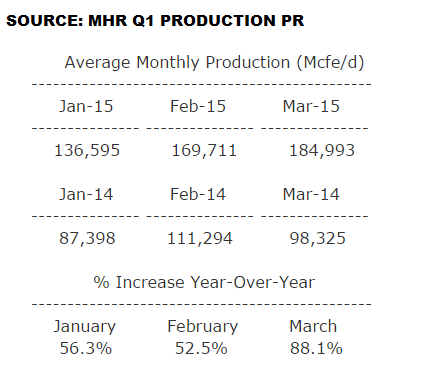

Summary- MHR announced greatly increased levels of production.

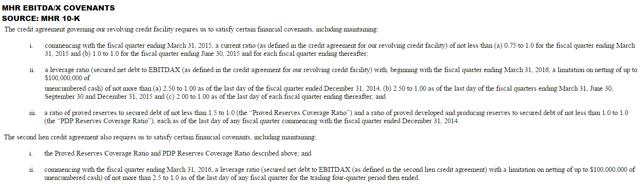

- I believe this is simply an act to maintain debt/EBITDAX covenant compliance and not something the company actually would prefer to do.

- Avoid MHR shares - the vicious cycle of borrowing to maintain covenants never ends well.

Another head scratching move out of Magnum Hunter Resources (NYSE:MHR) - what else is new? Or is it a head scratcher?

MHR's announcement that it has "increased" production ~66% (this production was expected to be online at the end of the year but slipped into Q1) for the three months ended 3/31/2014 came as a surprise to some but not a surprise to many familiar with the horrible financial situation at the company. And it is horrible.

Because of its gross mismanagement in the past MHR has two ways to keep itself going at this point - selling off ownership in Eureka Hunter (I've referred to this as using its "credit card" in the past) and increasing its EBITDAX. For clarity, MHR's EBITDAX is used as a measuring stick for determining the company's ability to maintain its debt - this is something its creditors are very concerned with checking in on.

The asset selling is self-explanatory and is something that MHR has little control over. The EBITDAX driving, however, MHR has total control over. MHR simply has to continue to increase production, at which it must continue to spend money (read: borrow), to maintain its compliance with debt covenants.

If it were to slow production (read: cut CAPEX and/or slow production/overall spending) like everybody in the space has (as of the new-year) and has further revised lower (very recently) it would likely come close to or definitively trip a covenant. That is the paradox of MHR. It's too far in debt, bringing it to a constant game of chicken with its covenants, but can't stop borrowing or slow its pace of spending because it would then trip a covenant. I've referred to this in the past as the MHR nightmare.

MHR must continue to grow its EBTIDAX at a faster rate than its debt (inclusive of "EBITDAX" decay that takes place from aging wells becoming less productive). Of course this "nightmare" could be reset if it were able, or willing to set aside its pride, to sell a large enough portion of its EurH and/or other assets away in an effort to reset the leverage ratio lower. Still, the execution of these efforts is not something I would consider a "selling point" of MHR. Who knows if that's even possible with the current state of the sector.

That said, don't expect MHR to do anything in the way of preserving its balance sheet (what's left of it) or protecting its assets for higher pricing down the road. It just won't and can't happen. MHR is strapped with debt that it must service by taking on more debt or face a covenant trip. The vicious cycle that MHR is caught in is near impossible to escape.

The Nightmare rages on until either 1) ~$4 natural gas or higher allows MHR to slowly get back to stable footing, 2) MHR sells away a big enough portion of its EurH ownership or assets to reset debt/EBITDAX much lower, or 3) MHR kicks the bankruptcy bucket. Either way, this has been one heck of fun stock to watch.

I am no longer long MHR despite my continued belief that natural gas pricing moves materially higher by the end of the year. I do not recommend a long position in MHR.

Good luck everybody.

-

Permalink Reply by searcherone on May 11, 2015 at 9:58pm

Permalink Reply by searcherone on May 11, 2015 at 9:58pm -

Interesting press release and conference call today from Gary Evans and Magnum Hunter. Link is to press release. Above is an excerpt from press release. Personally I am interested in which of the players will buy Ohio acreage as that will indicate just who thinks MH acreage is prime leasehold. Washington, Monroe and Noble counties pay attention to this.

http://magnumhunterresources.com/pressreleases.html

and here is link to transcript of conference call

http://seekingalpha.com/article/3169906-magnum-hunter-resources-mhr...

-

Permalink Reply by searcherone on May 12, 2015 at 11:17am

Permalink Reply by searcherone on May 12, 2015 at 11:17am -

http://seekingalpha.com/article/3173266-magnum-hunter-resources-des...

Very interesting analysis of MH and what it is doing. Written in plain language, no frills.

-

Permalink Reply by searcherone on May 26, 2015 at 5:23pm

Permalink Reply by searcherone on May 26, 2015 at 5:23pm

-

Permalink Reply by searcherone on June 8, 2015 at 12:05am

Permalink Reply by searcherone on June 8, 2015 at 12:05am

-

Permalink Reply by Suzy on June 8, 2015 at 2:43pm

Permalink Reply by Suzy on June 8, 2015 at 2:43pm -

Hi All ... very nice information regarding MH and Antero. Since we have leases held by MH and they have not performed in the past 3 years ... curious if we are part of the sale to Antero? Have not had any correspondence from either party.

-

Permalink Reply by searcherone on June 25, 2015 at 9:21am

Permalink Reply by searcherone on June 25, 2015 at 9:21am -

The above is from an 8-K filing and MHR says 600 million to 700 million could be raised by selling their remaining less than 50 percent ownership in Eureka Hunter pipeline. Will be interesting indeed to see if a major pipeline company makes the purchase which to me would indicate just how valuable the SE Ohio and WV acreage serviced by Eureka is worth.

-

Permalink Reply by Barb Smith on June 26, 2015 at 12:25pm

Permalink Reply by Barb Smith on June 26, 2015 at 12:25pm -

They are going belly up, look at the production numbers from any of the wells they have drilled and put online, I seem to remember the Stuart Winland well in Tyler County WV was supposed to be the strongest gas well drilled in North America according to Mr. Evans

-

Permalink Reply by J.D on June 26, 2015 at 1:36pm

Permalink Reply by J.D on June 26, 2015 at 1:36pm -

AMEN !!!! We should start a contest "Count How Many Lies Gary Evans Has Told" since the 1-23-15 conference call. Such as ..." we have buyers lined up outside the door" for $12,000 + an acre. Let's see if he can find a JV Financial partner to put up $500 million he said he wanted for the Ohio JV that will let Gary control the drilling program, remember he doesn't want another driller that will dictate to him [cause he knows what he is doing].

-

Permalink Reply by Dexter Green on June 26, 2015 at 3:06pm

Permalink Reply by Dexter Green on June 26, 2015 at 3:06pm -

Gary Evans is the Barack Obama of the oil industry. He gets away with promising the moon and then coming up short every time. The whole cult of personality that surrounds him amazes me. Head over to Seeking Alpha and read any article about MHR. His disciples come out in droves to support whatever nonsense he spits at them. The stock was up 26% on the news that, essentially, their creditors were not going to come after them for their next payment because they didn't want to crash the company. It's bizarro world.

-

Permalink Reply by Dexter Green on June 26, 2015 at 3:07pm

Permalink Reply by Dexter Green on June 26, 2015 at 3:07pm -

I'd expect that the sale will be directed by Morgan Stanley since they own the majority stake.

Top Content

Latest Activity

- Top News

- ·

- Everything

© 2024 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com