Is Gulfport the "EOG" of the Utica ?

Article related to EOG / Eagleford, but very interesting ...

The Eagle Ford is considered the best US unconventional oil play. This play has higher production and lower well costs. There are several problems associated with making such comparisons. The first is geology. This can change significantly from one mile to the next. At times it can even be difficult to compare similar areas of the same play. Source rock depth, thickness, lithology,permeabilities and porosities are just a few items that can significantly effect production and costs.

Operators are another issue. Every oil producer has its own well design. This design is another large set of variables that can affect production. Lateral length and stages are very important. The longer the lateral, the less verticals need to be drilled, which saves costs. The only problem with longer laterals is the operator can lose some control as it gets farther away. More importantly, it can tax the pump trucks' hydraulic horsepower during fraccing. The more stages the better. A stage will average a specific number of feet, and the more stages the fewer feet. The tighter the stage is, the higher the pressure used to stimulate the source rock. The wider and deeper the fractures, the better the recovery. Amounts and types of proppant are also important. Sand, ceramic coated sand and ceramic proppant are all types. Each operator uses a different recipe. It is more cost effective to use sand with a ceramic coated sand or ceramic proppant tail. This is more widely used due to lower costs. Some operators like Kodiak (KOG) use all ceramic proppant, which is more expensive but has proved to increase production substantially. The depth and pressures of the source rock are important in making proppant choices. As a general rule, depths of 7,000 feet or below can use just sand. The pressures are less so the sand probably won't crush under the weight of the formation. Water is also important. The more water used the deeper the proppant can be pushed into the fractures to prop it open. These are just some of the variables - all are difficult to compare from one well to the next.

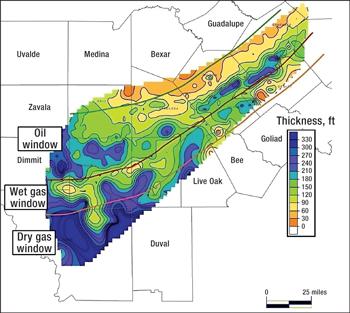

EOG Resources (EOG) is the leading producer in the Eagle Ford. When it initially announced the fantastic results in Gonzales County, many thought this was the best acreage in the United States. The map above provides Eagle Ford shale thickness. The dark blue area in Gonzales County is where EOG has part of its leasehold. The Eagle Ford has 300+ feet of shale thickness at this location. Below are its well results. It should be noted EOG has an average EUR of 400 MBoe net after royalty in the Eagle Ford. This is an average, as it recently stated its western wells have lower IP rates, but have total resource of 500 MBoe to 600 MBoe. My estimate for Gonzales County is 1,000 MBoe as an average for its sweet spot. These wells do not have large chokes. The IP rates are sound with chokes in the 20/64 to 32/64 range.

| Well | IP Oil | IP NGL | IP Gas |

| Baker-Deforest Unit 1H | 3346 | 457 | 2.7 |

| Baker-Deforest Unit 2H | 4216 | 537 | 3.2 |

| Baker-Deforest Unit 4H | 4598 | 488 | 2.9 |

| Boothe Unit 1H | 5380 | 625 | 3.6 |

| Boothe Unit 2H | 3810 | 252 | 3.0 |

| Burrow Unit 1H | 5424 | 600 | 3.5 |

| Burrow Unit 2H | 6331 | 713 | 4.1 |

| Henkhaus Unit 8H | 4012 | 495 | 3.0 |

| Reilly Unit 1H | 3579 | 483 | 2.9 |

The wells above are one mile laterals (5000 feet) with 20 stage fracs. In general, EOG uses 9 million pounds of sand and ceramic coated sand. It also uses 100,000+ barrels of water. EOG's completion technology is a game changer. If this is the reason for out performance, than it can be applied to the Bakken with similar results. The table below provides EOG's well design.

EOG's Completion Design| Well | Choke | Lateral | Proppant | Proppant/foot |

32473 - 32477 |

32/64 | 5499 | 8-10MM | 1637 |

| 32636 | 36/64 | 4510 | 8.55MM | 1896 |

| 32569 | 40/64 | 5126 | 11.16MM | 2177 |

| 32617 | 34/64 | 4111 | 10.01MM | 2435 |

| 32536 | 32/64 | 3775 | 5.82MM | 1542 |

| 35079 | 34/64 | 6293 | 9.53MM | 1514 |

| 34951 | 34/64 | 6373 | 10.09MM | 1583 |

| 33141 | 36/64 | 6489 | 10.04MM | 1547 |

| 33143 | 36/64 | 6599 | 10.12MM | 1534 |

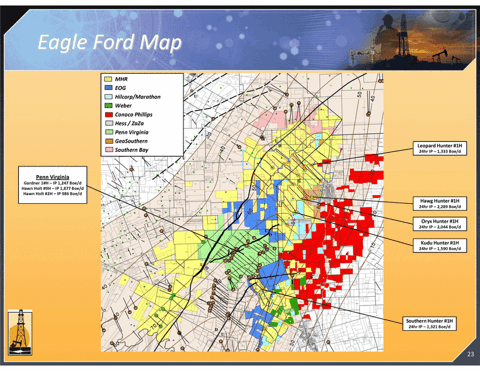

The above design uses between 1,500 to 2,400 pounds of sand per foot of lateral length. This is three to five times other operators. Better stimulation provides a larger void to fill with proppant. As EOG improves this technique, we will see larger amounts put down hole. EOG Resources isn't the only operator in this location. During the liquids rich unconventional land grab, several operators focused on this area. Magnum Hunter (MHR), Penn Virginia (PVA), Hunt and Marathon (MRO) are in this leasehold.

(click to enlarge)

As a comparison, I have provided well results in the same vicinity as EOG's Gonzales County leasehold. This is not a perfect comparison, as IP rates are not a great indicator of future production. Since all of these operators use a tight choke, it does show how this completion style produces initially. Below is a list of Magnum Hunter wells.

| Well | IP Rate (Boe/d) |

| Elk Hunter 1H | 1303 |

| Elk Hunter 2H | 1514 |

| Elk Hunter 3H | 1456 |

| Leopard Hunter 1H | 1333 |

| Hawg Hunter 1H | 2289 |

| Oryx Hunter | 2044 |

| Zebra Hunter 1H | 2145 |

| Rhino Hunter 1H | 2218 |

| Kudu Hunter 1H | 1590 |

| Southern Hunter | 1321 |

The above results by Magnum are very good, but it does not compare well to EOG's. It is currently using between 3 and 4 million pounds of sand. Magnum's acreage has EURs of 385 MBoe. EOG's acreage is in the general vicinity, only miles away to the southwest. Penn Virginia's acreage is also nearby. Its EURs in Gonzales County are 460 MBoe, and 590 MBoe in Lavaca. I have listed some of those results in the table below.

| Well | IP Rate (Boe/d) |

| Gardner 1H | 1247 |

| Hawn Holt 9H | 1877 |

| Hawn Holt 2H | 986 |

| Fojtik 1H | 1209 |

| Othold 1H | 1629 |

| Martinsen 1H | 1878 |

| Dubose 2H | 864 |

Penn Virginia's results are much like Magnum's. It uses on average 4 to 5 million pounds of proppant for a one mile lateral. It continues to use a very tight choke (16/64). It uses between 90,000 and 100,000 barrels of water. Both are the result of an older completion style. This data shows that Penn Virginia is either not using enough water and proppant or isn't stimulating the source rock as well. EOG is better at stimulating the source rock, especially around the well bore. More and better fractures provide easier flow of resource. Again, Penn Virginia and Magnum have good results, but not as good as EOG. Marathon is also in Gonzales County. Its wells have an IP rate range of 700 to 6,275 Boe/d. This is a very wide range, but recently Marathon had a great completion. Burrow 2H had an IP rate of 4646 barrels of oil, 798 barrels of NGLs, and 5 MMcfd. It used 835,4420 pounds of proppant for a 7,208 foot 27 stage lateral. Marathon estimates for average EURs in its Eagle Ford acreage are 694 MBoe. These wells are 65% oil and 17% NGLs. I hope the Burrow well is a sign of things to come. If it has adopted a completion style that better fracs the shale closer to the well bore, we could see other operators follow suit producing better IP rates and EURs.

In summary, EOG has outperformed in the Eagle Ford and Permian using a new completion design. Using this technique, it has outperformed its competition. In some cases, these results are 200% to 300% better. This completion design focuses around the well bore as opposed to creating long fractures, which has been the industry standard. By focusing around the well bore, more surface area can be stimulated, increasing the total area fractured. This frees up more resource, and in turn is the reason for EOG's excellent results.

EOG's competitors are in the same area, and although no one mile is identical it should produce similar results. Only one well has. Marathon's Burrow 2H produced like many of the successful EOG wells in the area. It did this using over 8 million pounds of proppant. It is possible Marathon has figured out what EOG has been doing, and is repeating it.

EOG has moved this design to the Bakken. As a result, it is reporting triple digit rates of return on its new wells. EOG already has one very successful Parshall Field well. This well models in the top ten. This is more impressive given it was in a developed location and should produce 10% less than a single well. EOG is using between 1,500 and 2,400 pounds of sand per foot. This compares to just 300 pounds by current Bakken operators. It is important to note that it isn't just the initial production that is affected, but we are seeing the depletion curve flatten. This technique not only opens up more surface area of the source rock, it keeps these open. In part two, I will show how EOG is using this completion style to garner returns as good as in the Eagle Ford.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not a buy recommendation. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results, do not take in consideration commissions, margin interest and other costs, and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market or financial product does not guarantee future results or returns. For more articles like this check out my website at shaleexperts.com. Fracwater Solutions L.L.C. engages in industrial water solutions for oil and gas companies in North Dakota. This includes constructing water depots, pipelines and disposal wells. It also provides contracting services for all types of construction at well sites. Other services include soil remediation. Please contact me via email if you are interested in working with us. More of my articles and other pertinent information on the oil and gas sector, go to shaleexperts.com.

Tags:

Replies to This Discussion

-

Permalink Reply by Booger on May 30, 2013 at 4:33am

Permalink Reply by Booger on May 30, 2013 at 4:33am -

" EOG has outperformed in the Eagle Ford and Permian using a new completion design. Using this technique, it has outperformed its competition. In some cases, these results are 200% to 300% better."

WOW.......very interesting article.

....agree that maybe Gulfport is using better techniques in the utica, rather than getting lucky with every well they drill......

-

Permalink Reply by Craig Stull on January 4, 2014 at 4:01am

Permalink Reply by Craig Stull on January 4, 2014 at 4:01am -

EOG in Ohio counties, Trumbull, Portage and Clumbiana counties !!

-

Permalink Reply by Mark McGrail on January 4, 2014 at 6:09am

Permalink Reply by Mark McGrail on January 4, 2014 at 6:09am -

Good news for western Trumbull County.

Maybe they'll move into Ashtabula.

-

Permalink Reply by Mark McGrail on January 4, 2014 at 8:01am

Permalink Reply by Mark McGrail on January 4, 2014 at 8:01am -

Craig,

What did you think of the production reported on the BP Lennington Well (10 days 604 bbl oil, 3869 mcf gas)?

Pretty disappointing I'd say. What do you think ?

-

Permalink Reply by Craig Stull on January 4, 2014 at 10:56am

Permalink Reply by Craig Stull on January 4, 2014 at 10:56am -

Mark,

If BP said this is what this well produced in 10 day, I believe them !! But whom is to say if the well is choked/ throttled back. Only BP knows this for sure. BP is going to make a anouncement some time early this year on there plans for the utica. If they were to pull out I would be disappointed.

-

Permalink Reply by Mark McGrail on January 4, 2014 at 1:27pm

Permalink Reply by Mark McGrail on January 4, 2014 at 1:27pm -

Craig,

Good point, it could be limited data on production.

I'm not sure it would be bad news if BP pulled out. I believe another company will take it's place. Look at EOG buying out Mountaineer Keystone. It's too early to stick a fork in Trumbull County. Plus if you research the History of BP I believe over the last twenty years they have begun several onshore projects and never finished one.

So the performance (or lack thereof) should not be seen as an indicator of the value of the Utica in Trumbull County. The good times are still ahead.

-

Permalink Reply by Jim Litwinowicz on January 5, 2014 at 9:52am

Permalink Reply by Jim Litwinowicz on January 5, 2014 at 9:52am -

From the article; As a general rule, depths of 7,000 feet or below can use just sand. The pressures are less so the sand probably won't crush under the weight of the formation.

Just to be clear, when they say "70000 feet or below" they mean shallower, not deeper. When you get deeper than 7000' the pressures crush the sand and the pathways that the fracking created become closed.

Good article, jives with what some people have posted about EOG before. As this gets better known and perfected, all companies will utilize this and get better results. Imagine the results when companies do this across the Utica and other shales.There will be a huge jump in production. Also, time to buy stock n companies that supply propants.

Of course, the down side for royalty owners is that while production will jump, prices will drop.

Top Content

Latest Activity

- Top News

- ·

- Everything

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com