http://seekingalpha.com/article/1964921-ipo-preview-rice-energy

Based in Canonsburg, PA, Rice Energy (RICE) scheduled an $800 million IPO on the NYSE with a market capitalization of $2.6 billion at a price range midpoint of $20 for Friday, January 24, 2014.

RICE is one of three IPOs scheduled for the week of January 20, 2013. The full IPO calendar can be found at IPOpremium.

Manager, Joint Managers: Barclays, Citi, Goldman Sachs, Wells Fargo Securities, BMO Capital Markets, RBC Capital Markets

Co-Managers: Comerica Securities, SunTrust Robinson Humphrey, Tudor, Pickering, Holt & Co.,

Capital One Securities, FBR Capital Markets, Scotiabank/Howard Weil, Johnson Rice & Co., Sterne Agee

End of lockup (180 days): Wednesday, July 23, 2014

Summary

RICE is in the business of shale oil/gas exploration, drilling and producing, mostly natural gas. RICE has identified 1313 gross drilling locations, 752 net (see page A-1 in the SEC filing for definitions).

Top line revenue increased to $124 million for the nine months ended September '13 from $53 million for the year ended December '12. Losses declined to $-8 million from $-13 million.

Focused on natural gas:

"As of September 30, 2013, our pro forma estimated proved reserves were 552 Bcf, all of which were in southwestern Pennsylvania, with 35% proved developed and 100% natural gas." (page 63 in the S-1 filing)

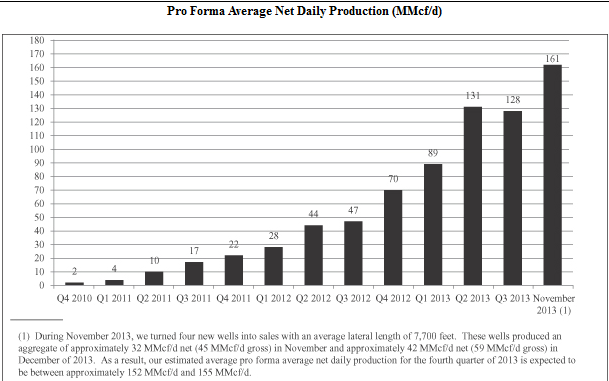

Production: Daily production is increasing. See below or this link.

Prices: The NYMEX Henry Hub prices as of September 30, 2013 were high $4.38 and $3.08 (page 66 in the S-1 filing).

Future prices look like they will hold steady at the higher level. The Henry Hub Natural Gas futures prices for the next four years are clustered in the $4.014 to $4.403 range. Detail here.

Rigs:

RICE currently running a four-rig drilling program. RICE began to delineate its Utica Shale leasehold position with the spudding of the first well in Belmont County in October 2013. See Utica Well below.

RICE expects to add two rigs to its drilling program in the first quarter of 2014, bringing the total rig count to six.

Valuation

Valuation Ratios |

Mrkt |

Price / |

Price / |

Price / |

Price / |

% offered |

annualizing Sept 9 mos '13 |

Cap (MM) |

Sls |

Erngs |

BkVlue |

TanBV |

in IPO |

Rice Energy |

$2,560 |

61.9 |

-240.0 |

2.2 |

3.2 |

31% |

Conclusion

Buy. To put the conclusions and observations in context, the following is reorganized, edited, and summarized from the full S-1 referenced above:

Business

RICE is an independent natural gas and oil company engaged in the acquisition, exploration, and development of natural gas and oil properties in the Appalachian Basin.

RICE is focused on creating shareholder value by identifying and assembling a portfolio of low-risk assets with attractive economic profiles and leveraging its technical and managerial expertise to deliver industry-leading results.

RICE strives to be an early entrant into the core of a shale play by identifying what it believes to be the core of the play and aggressively executing its acquisition strategy to establish a largely contiguous acreage position.

RICE believes it was an early identifier of the core of both the Marcellus Shale in southwestern Pennsylvania and the Utica Shale in southeastern Ohio.

RICE holds 43,351 pro forma net acres in the southwestern core of the Marcellus Shale, primarily in Washington County, Pennsylvania.

RICE established its Marcellus Shale acreage position through a combination of largely contiguous acreage acquisitions in 2009 and 2010 and through numerous bolt-on acreage acquisitions.

In 2012, RICE acquired 33,499 of its 46,488 net acres in the southeastern core of the Utica Shale, primarily in Belmont County, Ohio.

RICE believes this area to be the core of the Utica Shale based on publicly available drilling results. RICE operates a substantial majority of its acreage in the Marcellus Shale and a majority of its acreage in the Utica Shale.

Production, Drilling Success & Pro Forma Drilling Locations

Since completing its first horizontal well in October 2010, RICE's average net daily production has grown 64x to 128 MMcf/d for the third quarter of 2013.

RICE has drilled and completed 37 horizontal Marcellus wells and three horizontal Upper Devonian wells as of December 1, 2013, with a 100% success rate (defined as the rate at which wells are completed and produce in commercially viable quantities).

As of December 1, 2013, RICE had 1,313 gross (752 net) pro forma identified drilling locations, consisting of 349 gross (325 net) pro forma in the Marcellus Shale, 753 gross (233 net) in the Utica Shale, and 211 gross (194 net) pro forma in the Upper Devonian Shale.

Utica Well

In the fourth quarter of 2013, RICE began an initial Utica well, the Bigfoot 7H, in Belmont County, Ohio. In December 2013, after drilling approximately 1,200 feet of the lateral section within the Point Pleasant formation, the well unexpectedly began flowing gas with higher-than-anticipated bottomhole pressures of approximately 8,800 psi.

RICE employed certain steps that successfully controlled the gas flow. However, certain uncased sections in the vertical portion of the wellbore were compromised by the higher mud weight, which ultimately inhibited efforts to stabilize the gas flow and pressures.

RICE elected to plug the Bigfoot 7H in late December 2013, and is preparing to drill a new horizontal well adjacent to the Bigfoot 7H with reconfigured mud and intermediate casing designs that are intended to better manage higher anticipated pressures and gas flows.

RICE expects to obtain an initial production test from this well late in the first quarter or early in the second quarter of 2014.

Competition

The oil and natural gas industry is intensely competitive, and RICE competes with other companies in its industry that have greater resources than RICE does.

Many of these companies not only explore for and produce natural gas, but also carry on refining operations and market petroleum and other products on a regional, national, or worldwide basis.

These companies may be able to pay more for productive natural gas properties and exploratory prospects or define, evaluate, bid for, and purchase a greater number of properties and prospects than RICE's financial or human resources permit, and may be able to expend greater resources to attract and maintain industry personnel.

In addition, these companies may have a greater ability to continue exploration activities during periods of low natural gas market prices. RICE's larger competitors may be able to absorb the burden of existing, and any changes to, federal, state, and local laws and regulations more easily than RICE can, which would adversely affect its competitive position.

RICE's ability to acquire additional properties and to discover reserves in the future will be dependent upon its ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment.

In addition, because RICE has fewer financial and human resources than many companies in its industry, RICE may be at a disadvantage in bidding for exploratory prospects and producing natural gas properties.

5% stockholders

Rice Partners 20.4%

Rice Holdings 20.7%

NGP Holdings 44.4%

Alpha Holdings 10.2%

Daniel J. Rice III 22.8%

Use of proceeds

RICE expects to net $566 million from its IPO. Proceeds are allocated as follows:

to repay borrowings outstanding under the revolving credit facility of RICE's Marcellus joint venture

to make a $100 million payment to Alpha Holdings in partial consideration for the Marcellus JV Buy-In,

to repay borrowings under RICE's revolving credit facility

and the remainder to fund a portion of RICE's capital expenditure plan.

The remaining consideration for the Marcellus JV Buy-In will consist of RICE's issuance to Alpha Holdings of common stock with a value of $200 million (based on the initial public offering price of the common stock offered hereby).

Tags:

Replies to This Discussion

-

Permalink Reply by Bill Barnaby on January 24, 2014 at 4:25am

-

I'm going to guess they had planned to launch the IPO right after throwing out some big numbers from the bigfoot 7H well but when it never got fully drilled they were left with bad news.

Top Content

Latest Activity

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com