check out some of these drilling units - lateral spacing is shrinking - new techniques a "game changer"

i'm not sure if there is a connection.......but it seems the lateral spacing is basically being cut in half in some of these recent utica units.

and there is an operator in other shale formations that has been out performing competitors with a new technique that uses a bunch more sand and water but focuses close to the bore (vs longer fractures).

there was a thread a few weeks ago about EOG and their new technique;

“….using this technique, it has outperformed its competition. In some cases, these results are 200% to 300% better. This completion design focuses around the well bore as opposed to creating long fractures, which has been the industry standard. By focusing around the well bore, more surface area can be stimulated, increasing the total area fractured. This frees up more resource, and in turn is the reason for EOG's excellent results….”

“….EOG is using between 1,500 and 2,400 pounds of sand per foot. This compares to just 300 pounds by current Bakken operators. It is important to note that it isn't just the initial production that is affected, but we are seeing the depletion curve flatten…”

maybe some of this is being tried and tested by the utica operators......check out some of these DU's.

Tags:

- Attachments:

-

-

mccort DU.pdf, 3 MB

mccort DU.pdf, 3 MB -

eaglecreek DU.pdf, 2.5 MB

eaglecreek DU.pdf, 2.5 MB -

inherst DU.pdf, 2.3 MB

inherst DU.pdf, 2.3 MB

-

Replies to This Discussion

-

Permalink Reply by Booger on June 12, 2013 at 3:46am

Permalink Reply by Booger on June 12, 2013 at 3:46am -

here are a couple interesting ones....

the boyscout has 6 laterals - all 6 have different spacing...400', 600' 800' and 1,000'.....almost like they are testing different techniques, or checking how far out their fractures go.

the darla is really different....the 3 laterals start very close at 300' and then fan out to nearly 1,200'.....they are either testing somthing here, or are using a weird layout to drill a triangular shaped unit.

- Attachments:

-

-

boyscout all1.pdf, 4.1 MB

boyscout all1.pdf, 4.1 MB -

darla DU.pdf, 2 MB

darla DU.pdf, 2 MB

-

-

Permalink Reply by Booger on June 12, 2013 at 9:30am

Permalink Reply by Booger on June 12, 2013 at 9:30am -

Bob, you have confirmed my suspicions........thanks for the great info and links....those DU's i posted are all gulfport but i dont think it is just them.......some of the chk spacing is tightening up as well......700' mostly...i'm gonna see if i can find some of antero's too.

-

Permalink Reply by Robert Martin on June 12, 2013 at 5:02am

-

Re-post with all the details ...

Article related to EOG / Eagleford, but very interesting ...

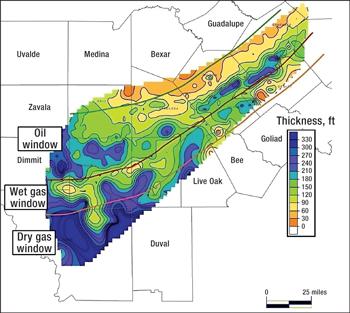

The Eagle Ford is considered the best US unconventional oil play. This play has higher production and lower well costs. There are several problems associated with making such comparisons. The first is geology. This can change significantly from one mile to the next. At times it can even be difficult to compare similar areas of the same play. Source rock depth, thickness, lithology,permeabilities and porosities are just a few items that can significantly effect production and costs.

Operators are another issue. Every oil producer has its own well design. This design is another large set of variables that can affect production. Lateral length and stages are very important. The longer the lateral, the less verticals need to be drilled, which saves costs. The only problem with longer laterals is the operator can lose some control as it gets farther away. More importantly, it can tax the pump trucks' hydraulic horsepower during fraccing. The more stages the better. A stage will average a specific number of feet, and the more stages the fewer feet. The tighter the stage is, the higher the pressure used to stimulate the source rock. The wider and deeper the fractures, the better the recovery. Amounts and types of proppant are also important. Sand, ceramic coated sand and ceramic proppant are all types. Each operator uses a different recipe. It is more cost effective to use sand with a ceramic coated sand or ceramic proppant tail. This is more widely used due to lower costs. Some operators like Kodiak (KOG) use all ceramic proppant, which is more expensive but has proved to increase production substantially. The depth and pressures of the source rock are important in making proppant choices. As a general rule, depths of 7,000 feet or below can use just sand. The pressures are less so the sand probably won't crush under the weight of the formation. Water is also important. The more water used the deeper the proppant can be pushed into the fractures to prop it open. These are just some of the variables - all are difficult to compare from one well to the next.

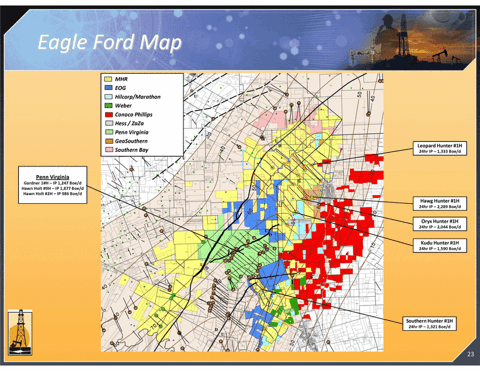

EOG Resources (EOG) is the leading producer in the Eagle Ford. When it initially announced the fantastic results in Gonzales County, many thought this was the best acreage in the United States. The map above provides Eagle Ford shale thickness. The dark blue area in Gonzales County is where EOG has part of its leasehold. The Eagle Ford has 300+ feet of shale thickness at this location. Below are its well results. It should be noted EOG has an average EUR of 400 MBoe net after royalty in the Eagle Ford. This is an average, as it recently stated its western wells have lower IP rates, but have total resource of 500 MBoe to 600 MBoe. My estimate for Gonzales County is 1,000 MBoe as an average for its sweet spot. These wells do not have large chokes. The IP rates are sound with chokes in the 20/64 to 32/64 range.

Well IP Oil IP NGL IP Gas Baker-Deforest Unit 1H 3346 457 2.7 Baker-Deforest Unit 2H 4216 537 3.2 Baker-Deforest Unit 4H 4598 488 2.9 Boothe Unit 1H 5380 625 3.6 Boothe Unit 2H 3810 252 3.0 Burrow Unit 1H 5424 600 3.5 Burrow Unit 2H 6331 713 4.1 Henkhaus Unit 8H 4012 495 3.0 Reilly Unit 1H 3579 483 2.9 The wells above are one mile laterals (5000 feet) with 20 stage fracs. In general, EOG uses 9 million pounds of sand and ceramic coated sand. It also uses 100,000+ barrels of water. EOG's completion technology is a game changer. If this is the reason for out performance, than it can be applied to the Bakken with similar results. The table below provides EOG's well design.

EOG's Completion Design

Well Choke Lateral Proppant Proppant/foot 32473 - 32477

32/64 5499 8-10MM 1637 32636 36/64 4510 8.55MM 1896 32569 40/64 5126 11.16MM 2177 32617 34/64 4111 10.01MM 2435 32536 32/64 3775 5.82MM 1542 35079 34/64 6293 9.53MM 1514 34951 34/64 6373 10.09MM 1583 33141 36/64 6489 10.04MM 1547 33143 36/64 6599 10.12MM 1534 The above design uses between 1,500 to 2,400 pounds of sand per foot of lateral length. This is three to five times other operators. Better stimulation provides a larger void to fill with proppant. As EOG improves this technique, we will see larger amounts put down hole. EOG Resources isn't the only operator in this location. During the liquids rich unconventional land grab, several operators focused on this area. Magnum Hunter (MHR), Penn Virginia (PVA), Hunt and Marathon (MRO) are in this leasehold.

(click to enlarge)

As a comparison, I have provided well results in the same vicinity as EOG's Gonzales County leasehold. This is not a perfect comparison, as IP rates are not a great indicator of future production. Since all of these operators use a tight choke, it does show how this completion style produces initially. Below is a list of Magnum Hunter wells.

Well IP Rate (Boe/d) Elk Hunter 1H 1303 Elk Hunter 2H 1514 Elk Hunter 3H 1456 Leopard Hunter 1H 1333 Hawg Hunter 1H 2289 Oryx Hunter 2044 Zebra Hunter 1H 2145 Rhino Hunter 1H 2218 Kudu Hunter 1H 1590 Southern Hunter 1321 The above results by Magnum are very good, but it does not compare well to EOG's. It is currently using between 3 and 4 million pounds of sand. Magnum's acreage has EURs of 385 MBoe. EOG's acreage is in the general vicinity, only miles away to the southwest. Penn Virginia's acreage is also nearby. Its EURs in Gonzales County are 460 MBoe, and 590 MBoe in Lavaca. I have listed some of those results in the table below.

Well IP Rate (Boe/d) Gardner 1H 1247 Hawn Holt 9H 1877 Hawn Holt 2H 986 Fojtik 1H 1209 Othold 1H 1629 Martinsen 1H 1878 Dubose 2H 864 Penn Virginia's results are much like Magnum's. It uses on average 4 to 5 million pounds of proppant for a one mile lateral. It continues to use a very tight choke (16/64). It uses between 90,000 and 100,000 barrels of water. Both are the result of an older completion style. This data shows that Penn Virginia is either not using enough water and proppant or isn't stimulating the source rock as well. EOG is better at stimulating the source rock, especially around the well bore. More and better fractures provide easier flow of resource. Again, Penn Virginia and Magnum have good results, but not as good as EOG. Marathon is also in Gonzales County. Its wells have an IP rate range of 700 to 6,275 Boe/d. This is a very wide range, but recently Marathon had a great completion. Burrow 2H had an IP rate of 4646 barrels of oil, 798 barrels of NGLs, and 5 MMcfd. It used 835,4420 pounds of proppant for a 7,208 foot 27 stage lateral. Marathon estimates for average EURs in its Eagle Ford acreage are 694 MBoe. These wells are 65% oil and 17% NGLs. I hope the Burrow well is a sign of things to come. If it has adopted a completion style that better fracs the shale closer to the well bore, we could see other operators follow suit producing better IP rates and EURs.

In summary, EOG has outperformed in the Eagle Ford and Permian using a new completion design. Using this technique, it has outperformed its competition. In some cases, these results are 200% to 300% better. This completion design focuses around the well bore as opposed to creating long fractures, which has been the industry standard. By focusing around the well bore, more surface area can be stimulated, increasing the total area fractured. This frees up more resource, and in turn is the reason for EOG's excellent results.

EOG's competitors are in the same area, and although no one mile is identical it should produce similar results. Only one well has. Marathon's Burrow 2H produced like many of the successful EOG wells in the area. It did this using over 8 million pounds of proppant. It is possible Marathon has figured out what EOG has been doing, and is repeating it.

EOG has moved this design to the Bakken. As a result, it is reporting triple digit rates of return on its new wells. EOG already has one very successful Parshall Field well. This well models in the top ten. This is more impressive given it was in a developed location and should produce 10% less than a single well. EOG is using between 1,500 and 2,400 pounds of sand per foot. This compares to just 300 pounds by current Bakken operators. It is important to note that it isn't just the initial production that is affected, but we are seeing the depletion curve flatten. This technique not only opens up more surface area of the source rock, it keeps these open. In part two, I will show how EOG is using this completion style to garner returns as good as in the Eagle Ford.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not a buy recommendation. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results, do not take in consideration commissions, margin interest and other costs, and are not guarantees of future results. All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market or financial product does not guarantee future results or returns. For more articles like this check out my website at shaleexperts.com. Fracwater Solutions L.L.C. engages in industrial water solutions for oil and gas companies in North Dakota. This includes constructing water depots, pipelines and disposal wells. It also provides contracting services for all types of construction at well sites. Other services include soil remediation. Please contact me via email if you are interested in working with us. More of my articles and other pertinent information on the oil and gas sector, go to shaleexperts.com.

-

Permalink Reply by Booger on June 12, 2013 at 9:38am

Permalink Reply by Booger on June 12, 2013 at 9:38am -

robert - thanks for the re-post .......i couldn't figure out how put a link to your thread on here.......this is a informative article.....exciting stuff...game changer indeed.

-

Permalink Reply by Samuel J. Orr on June 13, 2013 at 6:09am

Permalink Reply by Samuel J. Orr on June 13, 2013 at 6:09am -

To Robert Martin: would be very much appreciated if you could publish a similar analysis of the Utica especially western Pennsylvania and eastern Ohio. Your website is excellent. If you would honor my request I would consider paying the $410 annual subscription fee for info about the Utica. It is expensive but may well be worth the cost.

-

Permalink Reply by Robert Martin on June 13, 2013 at 7:14am

-

Samuel:

It was not my analysis or article. I just saw this as I follow both the Eaglford and Utica as I am a mineral buyer for a group of investors (focusing on the Utica right now). The article was from SeekingAlpha.com. EOG results in Gonzales County/ Eagleford Shale play are excellent.

Thanks,

Robert

-

Permalink Reply by Bluflame on June 14, 2013 at 3:14am

Permalink Reply by Bluflame on June 14, 2013 at 3:14am -

Robert,

This is a terrific post...thanks. I'm a "techie-sponge" for all shale info. While it is still too early to make a final assessment, I'd point out that several GPOR Utica wells and a few CHK Utica wells have "blown away" the IP rates in any other shale plays. With Utica midstream processing just coming on stream, the well completion pace should pick up significantly. We can then determine whether the very high IP's are an anomaly or will be the norm. Let's hope for the latter!

I guess the only downside is that the Utica big producers have so far been "more gassy" than Bakken or Eagle Ford wells.

Bluflame

-

Permalink Reply by Booger on June 13, 2013 at 5:37am

Permalink Reply by Booger on June 13, 2013 at 5:37am -

here are a couple recent CHK units with multiple legs......seems like they are currently using 700' spacing........i dont think they have many "drilled out" units established yet.....they drill a bunch of 1 or 2 legs, then move on....they must be trying to HBP as much as possible.

i wonder if they are lagging behind gulfport on the improved completion techniques.......seems gulfport has substantially better results.

- Attachments:

-

-

chk vlandinger 3H,5H,7H,10H,12H DU.pdf, 2.5 MB

chk vlandinger 3H,5H,7H,10H,12H DU.pdf, 2.5 MB -

chk schmuck8Hand10h DU.pdf, 1.6 MB

chk schmuck8Hand10h DU.pdf, 1.6 MB

-

-

Permalink Reply by Booger on June 13, 2013 at 6:53am

Permalink Reply by Booger on June 13, 2013 at 6:53am -

Bob - good point.......but if they use "long frac" technique at 700' spacing, then maybe those longer fractures would impede an additional lateral in between.

it seems gulfports production (at least IP rates) are significantly outpacing CHK's.......some of their wells are not all that far apart....gpor boy scout and chk henderson/addy area pads only 6 miles apart.........i know it's early, but if i had my 'druthers, i 'druther be drilled by gpor.

-

Permalink Reply by bo boboski on June 13, 2013 at 8:15am

Permalink Reply by bo boboski on June 13, 2013 at 8:15am -

Booger; Gulfport seems to have cracked the code, and getting better at it by the well. Not afraid to experiment. I bet this is exactly what the "big boys", Shell/Chevron/ Bp is waiting for. When the best drilling procedure is figured out for the Utica shale,to get the best production,you'll probably see them showing up to drill in eastern Ohio, without having to experiment.

-

Permalink Reply by Booger on June 13, 2013 at 9:14am

Permalink Reply by Booger on June 13, 2013 at 9:14am -

bo - i agree gpor seems to be on the way to cracking the code.....EOG in those other plays seems to be at the front....

i dont think chk is "afraid to experiment" but maybe their financial situation and/or the fact that they have so much land to HBP, inhibits them from experimentation........so maybe they too, are content to be in a holding patern like the other bigs....let someone else experiment. chk has plenty of single bores to HBP in the meantime

-

Permalink Reply by Donna Miller on June 13, 2013 at 8:43am

Permalink Reply by Donna Miller on June 13, 2013 at 8:43am -

How will this effect royalties?? Will it be better for landowner or company?

Top Content

Latest Activity

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com