Natural Gas production consumes literally millions of gallons of water during extraction through a process known as hydraulic fracturing or more simply, "fracking". The drought that the US is experiencing has the potential to significantly affect how much natural gas can be produced - which, in turn, has implications for the price of natural gas.

Water and Fracking

The fracking process involves injecting a pressurized, water-based fluid from a wellbore to fracture the rock formation into which it has been injected. This allows the hydrocarbons in the formation to travel up these fractures allowing for their easier extraction. This process has allowed for the extraction of natural gas from shale formations, which has introduced a vast source of newly recoverable natural gas from many regions in the southern and eastern parts of the USA.

The United States Environmental Protection Agency (U.S. EPA) reports that fracturing shale gas wells requires between 2.3 million and 3.8 million gallons of water per well. An additional 40,000-1,000,000 gallons is required to drill the well. Due to the greater depth of shale gas wells, considerably more water is required than for conventional gas wells and even for coalbed methane. In fact, CNN has reported that "Each shale well takes between two and 12 million gallons of water to frack. That's 18 Olympic-sized swimming pools worth of water per well."

The Pacific Institute last month released an important paper on fracking and dealt at length with the issue of water use. They would tend to support the larger CNN estimate and reported:

"New data, however, suggest that the water requirements for fracking shale gas wells might be both much larger and more variable than is reported by the U.S. EPA (Table 1). For example, Beauduy (2011) finds that fracking in the Marcellus region requires, on average, about 4.5 million gallons per well. Water requirements within Texas' Eagle Ford Shale area can be even greater, where fracking can use up to 13 million gallons of water per well (Nicot et al. 2011), with additional water required to drill the wells. These data highlight the significant variation among shale formations, driven in part by differences in the depth to the target formation and even among wells within close proximity of one another (Nicot et al. 2011). Estimating the water requirements is further complicated by the uncertainty about how many times a single well will be fracked over the course of its productive life and limited publicly-available data."

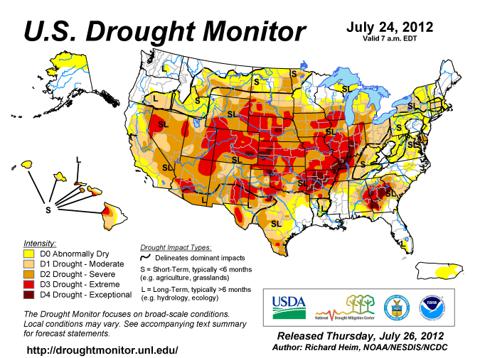

Over 60% of the Continental US is Currently Experiencing a Drought

This drought is serious. Drought Monitor reports that last week 63.85% of the lower 48 states were under moderate or worse drought conditions. This puts the largest area under drought conditions in the report's 12-year history, and the fourth consecutive week that a record was set.

Click to enlarge

Water Not Being Made Available For Drilling

It has started. On Tuesday, the Oil and Gas Journal reported:

"Water regulators in Pennsylvania told natural gas drillers to stop withdrawing water from certain streams in the Marcellus shale. One Dallas independent spoke with OGJ about how the drought is making it harder to buy water for fracing in the Eagle Ford in South Texas, and he suggested industry might see the same issue arising in the Bakken formation of North Dakota and Montana."

The Susquehanna River Basin Commission in Pennsylvania (SRBC) has on July 16 suspended permits to take water from the river's streams. The suspensions involve gas producers and others who rely on 64 water withdrawal areas across 13 Pennsylvania counties and one county in New York state.

SRBC, claimed this is the highest number of areas in which permits were suspended since June 2008 when SRBC began issuing such permits. It is not just in the Marcellus either. In the mid-west, Kansas farmers sell water to gas drillers, usually at $0.35 per barrel. Now they are turning down offers of $0.75 or more.

This Only Adds to the Deceleration in Natural Gas Production

Since the beginning of the year, natural gas production has slowed and in some cases, begun to decline. Keep in mind that gas production is seasonal and goes through two phases: injection season where production exceeds consumption and withdrawal season where the reverse is true. (Cross-season comparisons can be misleading.) Final production figures go through a frustratingly long delay, but the most recent EIA figures show that after peaking in January of this year, production declined in February and March. Injections into storage this year have been well below the 5 year a..., and prior to any effects of a drought, were showing signs of the glut in gas being removed. Now add to this body of evidence the prospect of further production curtailments due to a lack of water and you have an important implication to the balance of supply and demand.

Natural Gas Prices Are Likely to Continue to Rise

Natural gas prices have begun a significant recovery since plummeting 85% from their 2008 peak to the low reached at $1.90 per mbtu on April 19, 2012. The rise off that bottom is approaching 70%.

That rally has been the result of the re-balancing of supply and demand as production has slowed. The lack of water availability should be another factor in keeping supply in check and should allow prices to continue to move upwards over the near term. The United States Natural Gas ETF (UNG) tracks the price of natural gas and can be a good way to play this trend. For major natural gas producers such as Encana (ECA), Chesapeake (CHK), Anadarko (ADP), Exco (XCO) and Cabot (COG), this will be a double edged sword. They will benefit from any rise in the price of the product they sell, but may also experience reduced production.