Only Time Will (Sh)ell - More On Shell's Plan for a Marcellus/Utica Ethylene Plant

Whether or not Shell Chemicals follows through on its plan to build a $6 billion ethylene plant near Pittsburgh, PA –– and when that steam cracker comes online –– will have a significant impact on the U.S. ethane, ethylene and polyethylene markets. By consuming an estimated 90-100 Mb/d of ethane, the cracker’s operation would reduce the volume of ethane that needs to be moved out of the “wet” Marcellus/Utica production area, trim the amount of ethane available for export from marine terminals, and likely push ethane prices higher than they would otherwise be. Today, we examine what’s driving plans for the Northeast’s first cracker, and what effects the plant will have.

There’s an old story about two bear hunters, Roy and John, who hike deep into the forest to their hunting cabin. While Roy cleans up the cabin and puts away their gear, John goes outside to look for any signs of a bear. Not too much later, Roy hears John yelling “open the door, open the door!” Roy looks out the window and sees that John is being chased by a huge bear, so he opens the door of the cabin. Just as John reaches the door, he jumps to the side and the bear charges into the cabin. John slams the door shut and yells at Roy, “I caught the bear, now you skin him.”

In many ways Shell Chemicals’ recent commitment to a new ethane-based ethylene facility near the heart of the natural gas liquids (NGLs) production area in western Pennsylvania is an enormous bear. On June 7, 2016, Shell announced that it had made a Final Investment Decision (FID) to move forward with the $6 billion project to build a 1.5 million tonnes per annum (MTPA) ethylene plant and three polyethylene plants that will produce 1.6 MTPA of polyethylene. Polyethylene is used in many products, from food packaging and containers to automotive components. This FID does not fully “guarantee” that Shell will proceed with the project, but it represents a major commitment, and given the plant’s ready access to locally sourced ethane and Shell’s “first-mover” status (several other crackers have been under consideration in the Marcellus/Utica area), it is reasonable to conclude that the plant is likely to become a reality by 2021 or 2022. Construction of the cracker could begin as soon as late 2017 or early 2018.

The Shell cracker represents one of the biggest-ever industrial investments in the tristate region (Pennsylvania, Ohio, and West Virginia), whose industrial sector suffered a series of set-backs through the second half of the 20th century. To provide a forum to discuss the many issues facing the region, the company Petrochemical Update organized a conference entitled “Northeast U.S. & Canada Petrochemical Conference & Exhibition” which occurred on June 27 and 28, 2016 in Pittsburgh. At the conference, various industry experts discussed a wide variety of topics, including Shell’s description of the project; regulatory and permitting issues; development of a new energy hub; a potential shortage of regional skilled craft labor; strategies for successful project execution; and local natural gas and NGL infrastructure. Much of the content of this blog is based on the presentations at the conference.

RBN has been monitoring the status of Shell’s project for quite some time. We described the project in our blog Ain’t Wastin’ Time No More – Shell Chemicals Ready to Act on Ohio R..., and in Stranglehold – Would the Marcellus/Utica Benefit from In-region Eth... we discussed the challenges posed by the region’s lack of sufficient ethane storage capacity. We also undertook a detailed analysis of the regional midstream industry in a 2015 Drill Down report entitled Join Together with Demand: The Who and How of Marcellus/Utica Midst.... Soaring production of natural gas and NGLs in the Marcellus/Utica over the past few years initiated the construction of new infrastructure that was needed to process gas, remove NGLs and fractionate them into ethane and other “purity” NGL products, and move gas and NGLs to market. Many of the NGLs had ready-made markets in the local region, such as propane and butane for home heating and refining/blending. However, ethane had no local end-use markets in the nearby states. Thus, several projects were developed to allow ethane to be piped to the Gulf Coast and/or be exported to Canada and overseas markets. Furthermore, due to the lack of local ethane demand, several companies, including Shell, began to consider building ethane-based crackers in the region.

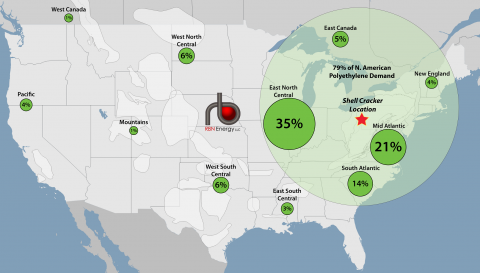

At the late June conference, Ate Visser, Vice President of Appalachia Petrochemicals at Shell Chemical LP, described the work that is already progressing at the company’s 340-acre brownfield site on the banks of the Ohio River in Potter Township, Beaver County, PA, which is about 30 miles northwest of Pittsburgh. This site was previously the location of a zinc smelter. Visser described the site as a “sweet spot” for an ethylene plant because it will be within a 700-mile radius of both a world-class supply of ethane and about 79% of U.S. and Canadian polyethylene customers. The location of the plant within this sweet spot is depicted in Figure 1, which is based on Shell’s official announcement of their project FID. Each of the green circles represents a U.S./Canadian regional polyethylene market. The size of each circle is proportional to the percent of total demand from that region, with the large light green circle indicating the 700-mile radius.

Figure 1; Source: RBN Energy, Shell Chemicals FID Announcement (Click to Enlarge)

Shell purchased the project site in late 2014, and has already started to prepare it by moving huge amounts of earth. The company also has relocated a rail line and a highway, built a new bridge across the Ohio River, and erected a new dock facility on the river to help move equipment on and off the site. These large expenditures are another indication of Shell’s intent to proceed with the project. About 400 people are reportedly employed in the site-preparation phase of the project, which is shown in the photograph in Figure 2 below.

Figure 2; Source: Akron Beacon Journal (Click to Enlarge)

Shell has received strong local support for the project, as well as substantial financial incentives from the commonwealth of Pennsylvania. Under the Keystone State’s “Resource Manufacturing Tax Credit” (which was enacted with Shell’s prospective cracker project in mind), starting in 2017, any company that develops an ethane-consuming ethylene plant valued at $1 billion or more (and that creates at least 2,500 jobs during the construction phase) would be eligible for a tax credit equal to 5 cents/gal (or $2.10/barrel) of ethane purchased and used to produce ethylene. The tax credit, which applies to ethane purchased between January 2017 and December 2042, can be used to reduce Shell’s overall tax liability to the state by up to 20%. Assuming that Shell’s plant starts up in January 2021, remains operational through December 2042 (22 years), and consumes an average of 85 Mb/d (close to full capacity, that is), the tax credit’s value would total $1.43 billion ($2.10/b x 85,000 b/d x 365 days x 22 years). Separately, Shell reached agreements with Potter Township, Beaver County and the local school district on “payments in lieu of taxes” (PILOT) that those entities will receive from Shell during a 22-year period in exchange for their support for Shell’s project site being named a Keystone Opportunity Expansion Zone (KOEZ). For qualifying projects within a KOEZ, local taxes and state sales taxes are waived. Visser noted that these incentives were a very important component of Shell’s decision to proceed with the project.

Visser also said that the timing of the cracker project is also important because the U.S. ethylene market by the early 2020s should have have had time to absorb the production of several new ethylene plants along the Gulf Coast. We understand that Shell has negotiated 10-year to 20-year ethane supply agreements with about 10 producers. Several speakers at the conference described the ethane resource that is available in the Marcellus/Utica region. The total NGL content of the gas is fairly high and the ethane content in the NGL barrel varies considerably from well to well –– ranging between 50% (high) and 70% (super-high). This high ethane content is both a problem and an opportunity for the gas/NGL producers. The problem is that the ethane content of many wells is so high that some of it must be recovered, and cannot be left in the natural gas, or “rejected.” One speaker at the conference estimated that 25% to 30% of the available ethane in the region needs to be recovered to meet natural gas pipeline specifications. As we said in Ain’t Wastin’ Time No More, without a local ethylene industry to utilize the ethane, gas producers and processors need to move out of the production area by pipeline all of the ethane that they cannot reject into gas. (Their options include Enterprise Products Partners’ ATEX pipeline to the Gulf Coast; Sunoco Logistics’ Mariner West pipeline to Sarnia, ON; Sunoco Logistics’ Mariner East 1 pipeline to the deepwater port at Marcus Hook, PA for waterborne exports; and –– in the future –– Sunoco’s planned Mariner East 2 pipeline expansion to Marcus Hook and Kinder Morgan’s Utopia East pipeline to Sarnia. Assuming Shell’s cracker is built, these “takeaway” pipelines by the early 2020s will be competing with the Shell cracker for regional supplies of ethane.

Construction of Shell’s new cracker is certainly big news for the tristate area. Shell estimates that the number of new skilled-labor jobs (pipefitters, welders, electricians, etc.) that will be created during the construction phase of the project is likely in the range of 6,000. Shell also expects that about 600 permanent jobs will be created to operate and maintain the ethylene and polyethylene plants. Furthermore, conference presenters indicated that indirect employment from the project could approach 15,000 to 30,000 new jobs. This job creation aspect of the project was described by one speaker at the conference as the “common denominator” for politicians in the tristate area.

The construction phase of Shell’s project is probably the biggest part of the “bear that needs to be skinned.” Several speakers at the conference noted that Shell’s new cracker will be the first U.S. ethylene plant that has been built outside of the Gulf Coast in the last 30 to 40 years. Also, no large industrial projects have been constructed in the tristate region in at least three decades. The consensus view appears to be that the current lack of skilled construction personnel within the tristate region will be a problem. Worker training efforts will help, but becoming fully licensed by a labor union can take as long as four years. Thus, a lot of training needs to start immediately.

If a large construction project does, indeed, experience manpower limitations, speakers at the conference agreed that improved productivity can offset some of the issues. Therefore, the use of modularization was discussed. For example, major elements of the cracker or polyethylene plants can be constructed in other regions and transported to the Shell cracker site (by barge, rail or truck) rather than be built from scratch at the project site. These concepts must be developed and integrated into a project very early in the design stage. Also, modularization only spreads out the “density” of the manpower requirements (between Pennsylvania and other states, such as Texas, Oklahoma and Louisiana). It’s important to remember that Shell is a highly sophisticated company that has skinned many bears in the past, and that clearly understands the many challenges before it on the Marcellus/Utica cracker project.