Gulfport Buying 35,000 Acres in Monroe, Belmont, Jefferson Counties of Ohio from American Energy Utica

Aubrey is selling a huge amount of acreage to Gulfport.

http://www.gulfportenergy.com/news/press-releases/detail/1273/gulfp...

OKLAHOMA CITY, June 9, 2015 (GLOBE NEWSWIRE) -- Gulfport Energy Corporation (Nasdaq:GPOR) ("Gulfport" or the "Company") today announced that the Company has entered into agreements to acquire additional acreage in the Utica Shale, associated assets and incremental firm transportation commitments from American Energy – Utica, LLC ("AEU").

Acquisition Highlights

- Contiguous bolt-on acreage acquisitions totaling approximately 35,325 net acres in Monroe, Belmont and Jefferson Counties, Ohio

- 11 mile gas gathering system currently in-place and operational in Monroe County to support near-term development

- Incremental 287,000 MMBtu per day of firm transportation commitments provide access to favorable pricing points outside of the Appalachian Basin

As of June 8, 2015, Gulfport purchased approximately 6,198 gross (6,198 net) acres in Belmont and Jefferson Counties, Ohio from AEU for a purchase price of approximately $68.2 million, subject to adjustment (the "Belmont/Jefferson acquisition"). This acreage is located near or adjacent to the acreage included in Gulfport's previously and still pending announced acquisition of Paloma Partners III, LLC ("Paloma"). This newly acquired Belmont and Jefferson County acreage is undeveloped and is expected to fit into the Company's development plan for the Paloma acreage area.

Also as of June 8, 2015, Gulfport entered in to a definitive purchase agreement with AEU to acquire approximately 38,965 gross (27,228 net) acres located in Monroe County, Ohio, 14.6 MMcfpd of net production estimated for April 2015, 18 gross (11.3 net) drilled but uncompleted wells, one fully constructed four well pad location and an 11 mile gas gathering system for a total purchase price of approximately $319.0 million, of which approximately $52.0 million has been allocated to the existing production and the drilled but uncompleted wells and $20.0 million has been allocated to the gathering system (the "Monroe acquisition"). Gulfport has also agreed to acquire an additional 4,950 gross (1,900 net) acres in Monroe County for an additional approximately $19.4 million from AEU if AEU completes the acquisition of such acreage within 30 days of the closing of the Monroe acquisition (the "additional Monroe acreage"). The Monroe County acreage has an NRI of approximately 84% and is approximately 85% held by production by a ten well per year drilling commitment. The Monroe acquisition is expected to close by mid-June 2015, subject to the satisfaction of certain closing conditions. Gulfport currently intends to add one rig to operate on this acreage beginning in the first quarter of 2016.

Pro forma for the full 35,325 net acres contemplated in the Belmont/Jefferson acquisition and the Monroe acquisition, including the additional Monroe acreage, and the full 24,000 net acres subject to the pending Paloma acquisition, Gulfport's holdings of Utica Shale leasehold are expected to total approximately 262,000 gross (243,000 net) acres under lease in the core of the play. Gulfport will become the operator of all the acreage acquired in these transactions with AEU and anticipates that this acreage will add approximately 200 net locations to its existing drilling inventory, based on 160-acre spacing. The AEU acreage overlaps with a number of Gulfport's currently planned units and is located in the vicinity of existing interstate pipelines with gathering and compression infrastructure already under development.

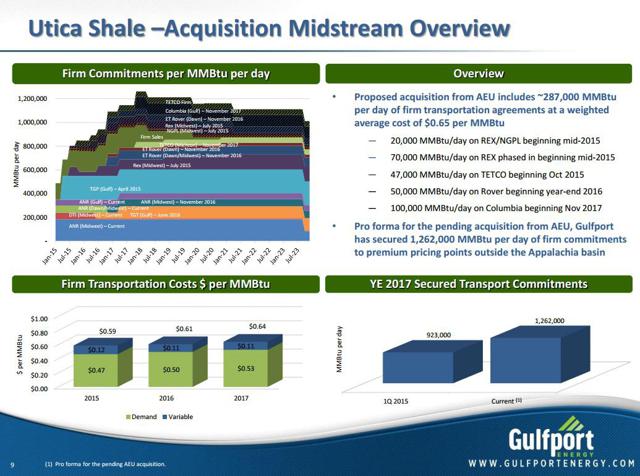

Accompanying these transactions are incremental firm transportation commitments totaling 287,000 MMBtu per day to be phased in over a multi-year period beginning in mid-2015, which are expected to support Gulfport's production growth and allow the Company to continue to access premium gas markets across North America, including the Gulf Coast, Michcon and Dawn regions, while further diversifying its basin exposure away from local Appalachian markets. Pro forma for the incremental 287,000 MMBtu per day of firm transportation commitments contemplated by this transaction, Gulfport has secured firm commitments covering approximately 1,262,000 MMBtu per day of natural gas production by year-end 2017.

About Gulfport

Gulfport Energy Corporation is an Oklahoma City-based independent oil and natural gas exploration and production company with its principal producing properties located in the Utica Shale of Eastern Ohio and along the Louisiana Gulf Coast. In addition, Gulfport holds a sizeable acreage position in the Alberta Oil Sands in Canada through its 24.9% interest in Grizzly Oil Sands ULC.

Tags:

Replies to This Discussion

-

Permalink Reply by Dexter Green on June 9, 2015 at 1:34pm

Permalink Reply by Dexter Green on June 9, 2015 at 1:34pm -

Gary Evans sells acreage for ~$7,000/ac and he's heralded as a genius. Aubrey sells for ~$12,000/ac...and he's probably going to get trashed in the stock world blogosphere.

-

Permalink Reply by searcherone on June 9, 2015 at 1:45pm

Permalink Reply by searcherone on June 9, 2015 at 1:45pm -

And interesting thing is Monroe and Tyler are only separated by the state line in the Ohio River. Their unseen pools of oil and gas could be very much the same! Big price per acre difference. And are Gary and Aubrey in the same pickle---strapped for cash? Aubrey really sold in three very prime counties in Ohio, of course that is my opinion.

-

Permalink Reply by Dexter Green on June 10, 2015 at 6:25am

Permalink Reply by Dexter Green on June 10, 2015 at 6:25am -

Aubrey's game is very different. Check out the corporate structure of AEP, LP vs. the subsidiaries. It's like how Cheniere set up their LP vs. the S-Corp. It's one step shy of a Ponzi scheme, really. It's financial wizardry at its finest. This is just the beginning.

-

Permalink Reply by bo boboski on June 9, 2015 at 10:08pm

Permalink Reply by bo boboski on June 9, 2015 at 10:08pm -

Gulfport has been slowly,but surely moving away from Guernsey county, Aubrey has been moving in. Seems AEU is more interested in oil,than gas. Maybe he knows something Gulfport doesn't?

-

Permalink Reply by Paul Butler on June 10, 2015 at 10:01am

Permalink Reply by Paul Butler on June 10, 2015 at 10:01am -

This text is from the Columbus biz journal:

"What do all of these moves mean for Aubrey McClendon and American Energy Partners? Clearly the transactions were conducted in order to generate cash. MDN's Jim Willis reported that he has heard from at least one vendor who has been waiting over 120 days for payment from AEP for work that his company performed. Does that mean that McClendon's new venture is encountering some of the same cashflow problems that Chesapeake Energy was facing before his departure?

AEP vendors probably would like to see more payments and less wizardry.

I hate deadbeats!

-

Permalink Reply by searcherone on June 10, 2015 at 12:31pm

Permalink Reply by searcherone on June 10, 2015 at 12:31pm

-

Permalink Reply by williet57 on June 10, 2015 at 1:12pm

-

Didn't Chesapeake just win a lawsuit against Aubrey Mclendon and AEU had to give Cheasapeake 35,000 acres in Harrison County Ohio?

-

Permalink Reply by searcherone on June 10, 2015 at 2:16pm

Permalink Reply by searcherone on June 10, 2015 at 2:16pm -

It was 6,000 acres and up to 25 million dollars. It was a mid April decision.

-

Permalink Reply by williet57 on June 10, 2015 at 11:45pm

-

My mistake it was 6000 acres and 25 million dollars,sorry

-

Permalink Reply by Philip Brutz on June 12, 2015 at 1:12am

Permalink Reply by Philip Brutz on June 12, 2015 at 1:12am -

Gulfport Energy: Opportunistic Consolidator In The Dry Gas Utica

http://seekingalpha.com/article/3251295-gulfport-energy-opportunist...

Oil & gas, commodities, long/short equity, research analystMust Read | Jun. 11, 2015 6:15 AM ET | About: Gulfport Energy Corporation (GPOR)Subscribers to SA PRO had an early look at this article. Learn more about PRO »Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Summary

- Following the recent acquisitions, Gulfport’s dry gas opportunity set in the Utica may rival or exceed its core condensate/wet gas position.

- ~$1 billion equity financing maintains balance sheet strength and reduces budget deficit, albeit at a cost of a ~26% increase in the share count.

- The dry gas Utica play is still in early stages of delineation.

- Being positioned in the play’s sweet spot appears to be a pre-requisite for the economics to work.

- Takeaway congestion and ensuing high transportation costs make a big dent in price realizations.

Important Note: This article is not an investment recommendation or research report. It is not to be relied upon when making investment decisions - investors should conduct their own comprehensive research. Please read the Disclaimer at the end of this article.

With a second significant transaction in just two months, Gulfport Energy (NASDAQ:GPOR) substantially increased its exposure to dry gas in the Utica. Excluding producing and midstream assets, Gulfport paid over $600 million for ~60,000 net undeveloped acres located mostly in the core of the Utica's dry gas window, arguably the nation's most prolific gas play.

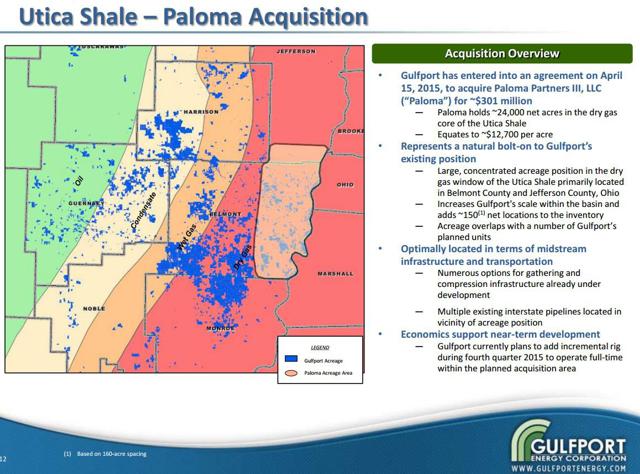

As a reminder, two months ago, Gulfport announced the acquisition of Paloma Partners III, LLL for a total purchase price of ~$300 million. Paloma holds ~24,000 net nonproducing acres in Belmont and Jefferson Counties, Ohio (the map below).

(Source: Gulfport Energy, May 2015)

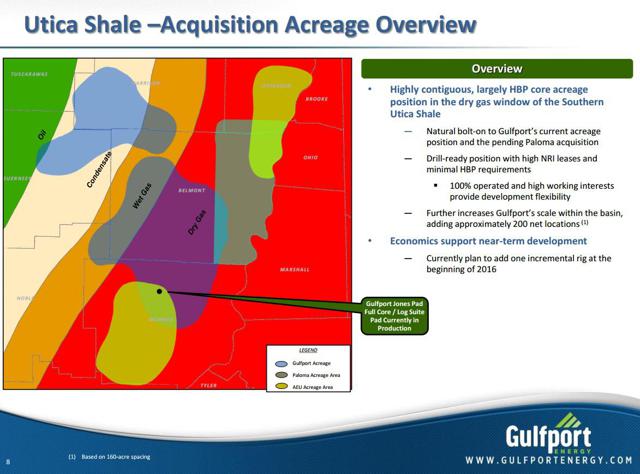

In another transaction announced yesterday, Gulfport agreed to acquire up to a total of ~35,325 net acres from American Energy - Utica, LLC for $407 million. (American Energy - Utica is one of the start-up companies under the umbrella of American Energy Partners, a private equity partnership led by Aubrey McLendon). The vast majority of the acquired acreage is located in Monroe County in the area where drilling has been active and acreage should be reasonably well delineated. The remaining acreage is located in Belmont and Jefferson Counties (the map below).

(Source: Gulfport Energy)

Given the challenging current natural gas price environment and uninspiring forward strip, the implied price of $10,000+ per undeveloped acre paid in the acquisitions does not appear particularly low. Assuming 160-acre spacing and risking the acreage by 50%, Gulfport is effectively paying ~$3 million per drilling location.

That being said, the acquisitions are strategic in nature as they substantially expand Gulfport's already meaningful position in the dry gas window and making its scale comparable to the company's core position in the condensate and super-rich gas windows.

In these transactions, Gulfport is a well-informed acquirer, given that the acquisition areas are contiguous with Gulfport-Rice JV acreage in Belmont County. Rice Energy (NYSE:RICE), the operator of the JV's dry gas acreage, has demonstrated exceptionally strong and highly consistent early-time performance of the dry gas Utica tests.

The American Energy acquisition also comes with a meaningful number of producing and pre-drilled wells that should have given Gulfport substantial additional geological and geophysical data to evaluate the asset's quality by establishing correlations with Rice's well results.

Gulfport has also used these acquisitions as an opportunity to de-lever its balance sheet. Once the pending equity offering closes, Gulfport will have raised ~$270 million of new equity in excess of the price paid in the acquisitions. By financing the acquisitions with equity at, arguably, attractive prices per share, Gulfport has substantially reduced the risk associated with the transactions. In the event natural gas prices disappoint and the price paid proves too high, existing shareholders will be minimally impacted. If, on the other hand, natural gas prices firm up and the assets live up to an optimistic expectation, the significant undeveloped acreage position in the core of the play should provide significant upside torque.

The American Energy Transaction

~29,127 net acres in Monroe County:

- ~ 66% average working interest

- ~16% average royalty burden

- a drilling requirement of 10 wells per year to hold 85% of the acreage

~6,198 net acres in Jefferson and Belmont Counties

- 100% working interest

Total purchase price is ~$407 million.

The acquisition price includes $52 million of value assigned to:

- ~15 MMcfpd of production,

- 9 net drilled uncompleted wellbores and

- interests in 9 gross (2.3 net) Gulfport wells undergoing completion.

The acquisition also includes a gathering system currently in place and operational in Monroe County - 11-mile, 12-inch, steel system running through the acquired acreage - with a 350 MMBtu/d interconnect with TETCO. The gathering system has a book value of $20 million.

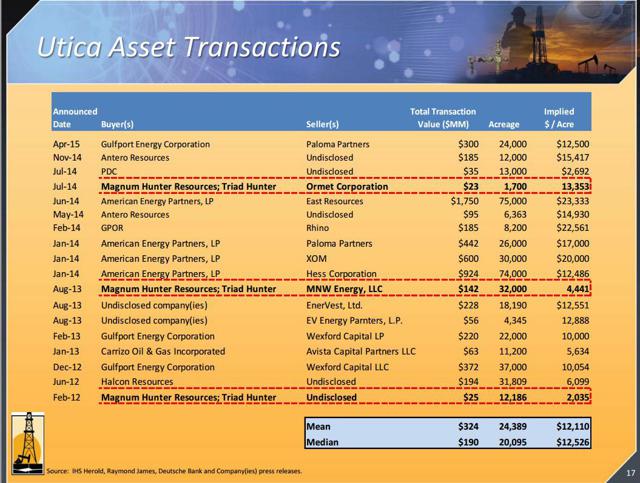

These metrics imply ~$10,000 paid per net undeveloped acre. The valuation is at the low end of the historical range for significant transactions involving top quality undeveloped acreage in the Utica (the list below illustrates the range of valuations per acre). However, given the dramatic drop in the long-term natural gas futures and the high cost of transportation out of the basis, the acquisitions are not inexpensive and imply an expectation of a material improvement in the natural gas prices.

(Source: Magnum Hunter Resources, June 2015)

Firm Transportation Acquired

Another important element of this transaction is that it includes significant firm transportation capacity commitments providing Gulfport with incremental access to favorable pricing points as its production ramps up. A total of ~287,000 MMBtu per day of firm transportation will be phased in over a multi-year period beginning mid-2015 and has a weighted average cost of ~$0.65 per MMBtu, which appears reasonable by the Marcellus/Utica standards. Transportation commitments provide delivery to Dawn, Midwest and the Gulf Coast pricing points that trade at prices similar to Henry Hub.

While it is difficult to assess the current market value of this FT portfolio, securing adequate arrangements in advance remains a precondition of a successful development in the play in the near future. Given the moderate cost, the FT portfolio may have a tangible mark-to-market value.

(Source: Gulfport Energy)

A Second Equity Offering In Two Months

Concurrent with yesterday's acquisition announcement, Gulfport launched a 10 million-share stock offering which priced this morning at $43.25 per share. Assuming the "green shoe" is exercised in full, net proceeds to Gulfport will be ~$480 million. The net proceeds from the offering will be used to fund a portion of the recently announced acquisitions as well as for general corporate purposes, including the funding of a portion of its 2015 capital development plans.

This is a second equity offering by Gulfport in two months. In April, in conjunction with the Paloma acquisition, Gulfport closed an upsized offering of 10,925,000 shares of the Company's common stock, including "green shoe" shares. The company received net proceeds of approximately $502 million after discounts and expenses.

In total, Gulfport will have raised close to $1 billion in fresh equity, substantially strengthening its balance sheet and funding a portion of its capital spending program.

I should note that full equity financing is logical (and essentially required) in the context of a large acquisition of undeveloped acreage.

The Risk And Potential Reward

While the timing appears opportune to acquire high-quality dry gas assets in a promising emerging play, the move is not without risk, both geologic and execution-related.

Gulfport did not provide detailed acreage maps. However, as one can see from the Paloma acreage map above, the position may require substantial blocking-up work (which also provides opportunities for bolt-on expansions). It is also worth noting that the Paloma acreage appears to be located downdip from Rice-Gulfport JV acreage in Belmont County. Therefore, it would not be surprising if well costs on the Paloma acreage prove to be meaningfully higher.

I should also note that the dry gas Utica remains an early-stage play. While several operators have reported very strong early results in the dry gas window, well costs tend to be on the high side and the bar for well performance is set high as a result.

The spectrum of well performance has also been relatively wide, which indicates that not all areas along the dry gas fairway may be equally productive and economic. Further delineation work is required.

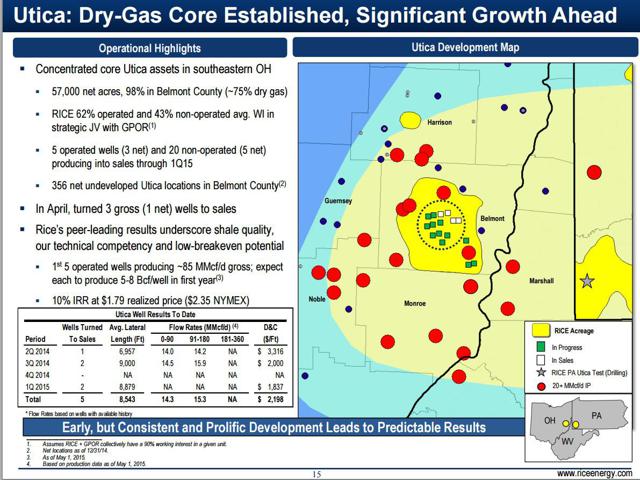

The following slide from Rice Energy's presentation shows select Utica well results to date. Red and blue dots on the right hand side of the map correspond to wells in the dry gas window.

(Source: Rice Energy, June 2015)

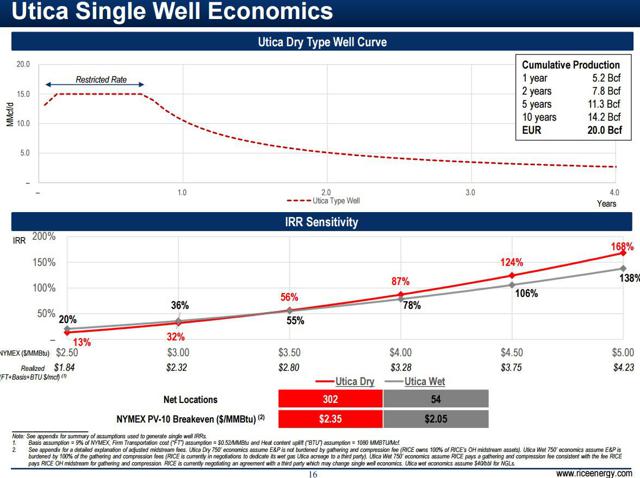

Rice remains the leader in terms of dry gas Utica drilling economics, based on public data. Still, Rice's current type curve for Utica suggests that a $3.50/MMBtu Henry Hub price environment would be required to make a 20-Bcf well in the Utica truly compelling in terms of well-level drilling economics (IRR of 50% assuming $3.50 flat Nymex price).

(Source: Rice Energy, June 2015)

Given Rice's position in the relatively shallow portion of the dry gas window and given its leading-edge well results in the play, I would not rush to extrapolate the drilling economics estimate for Rice on to other areas in the play and other operators.

In other words, I would not take drilling economics in dry gas Utica for granted, particularly given the stubborn oversupply of the Marcellus gas and ensuing high transportation costs out of the basin.

The Consolidation Trend

The acquisitions by Gulfport illustrate the trend that is likely to continue in the foreseeable future in the U.S. Oil & Gas industry - even in the most promising plays, drilling opportunities significantly exceed available capital and, in many cases, takeaway capacity.

As a result, the ownership landscape will continue to evolve. Operators with access to capital and willingness to take risk have ample opportunity to increase their positions and even enter new plays at a reasonable cost. Recent acquisitions by Antero Resources (NYSE:AR) and Southwestern Energy (NYSE:SWN) offer further illustrations to this trend.

The likely side effect of this consolidation trend is increased competition for takeaway capacity and higher supply chain costs, as new external capital flowing into shale plays via M&A-related financings effectively fuels above-cash-flow spending.

Top Content

Latest Activity

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com