Saudi Arabia: An IPO of their Oil Company Aramco?

Here is an article from the New York Times posted just a few hours ago that tells of the 47 executions carried out today by the Saudi government.

http://www.msn.com/en-us/news/world/iranian-protesters-ransack-saud...

Here is a Seeking Alpha article published in the last couple of days. I have read the entire article as well as the comments which are full o viewpoints that we are not reading/discussing on GMS. IMHO thinking of the info in both articles the oil price is being manipulated for political purposes in Saudi Arabia and the Middle East region. The stability of the region IMHO is the weakest it has been in the past 65 years.There are no easy answers for the resolution of the instability and its implications for the price of oil.

http://seekingalpha.com/article/3785606-the-game-changer-saudi-arab...

Tags:

Replies to This Discussion

-

Permalink Reply by Joseph-Ohio on January 7, 2016 at 9:54pm

Permalink Reply by Joseph-Ohio on January 7, 2016 at 9:54pm -

Looks to me like every other country in the world (M.E. and / or Asia for sure) are choosing sides / creating alliances.

I'm thinking it's way past time for us to be doing likewise.

Don't like saying I told you so - but I did.

NWO looks to be a dead horse to me. Or......what.......an IPO as a fresh new way to fund the bad guys ? ?

What do you folks think / say ? ?

P.S.: Thinking it's a pretty dumb move to be kicking our Canadian friends in the shins these days. I read on here earlier that Canada is bringing some kind of suit against the U.S.A. over the POTUS refusing to approve Keystone. What court would preside over that action I wonder ? ?

-

Permalink Reply by Philip Brutz on January 12, 2016 at 2:53am

Permalink Reply by Philip Brutz on January 12, 2016 at 2:53am -

http://seekingalpha.com/article/3802626-would-an-ipo-of-the-worlds-...

Would An IPO Of The World's Most Valuable Oil Company Generate Great Returns For Investors?Jan. 11, 2016 12:49 PM ET|Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Summary

Largest IPO in history may be on the horizon.

Saudi Arabia looking for revenue alternatives.

Even a small part of Saudi Aramco would be huge.

A number of variables would determine its attraction to investors, including the stock exchange or exchanges it would be listed on.

What this confirms about the oil market and the price of oil.

In a recent interview with 'The Economist,' Saudi Arabian deputy crown prince Muhammad bin Salman said one of the things he's taking into consideration as a way to relieve the financial burden on the government from an expected prolonged period of low oil prices, is to go the IPO route with state-owned oil giant Saudi Aramco.

Not only is it the most valuable oil or energy company in the world, it's probably the valuable company in the world too.

We'll look at the implications of this to investors if it does go this route. Meanwhile, it's worth mentioning it confirms my thesis that Saudi Arabia knows the price of oil will remain subdued for a prolonged period. With the emergence of shale oil competitors, it will inevitably come to the place it will lose global market share.

One thing to keep in mind is the demand for oil, over time, should increase, which means the size of the market will grow with it. That will shrink the market share of Saudi Aramco on that basis, assuming it doesn't have a lot more supply it can release.

But even if that wasn't happening, it would still lose market share because of shale companies being able to quickly respond to a rebound in prices, resulting in the price ceiling remaining lower than in the past because of a quick increase in supply.

This means less revenue and a growing strain on reserves, which is the reason Saudi Arabia is stepping back from trying to influence OPEC members to cut back on production; it needs to keep the money coming in order to buy time to make the many changes it needs to in a lower revenue environment. This is the primary impetus behind thinking about an IPO with Saudi Aramco.

source: SOLENT

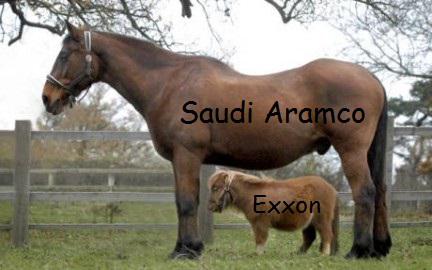

Measured against Exxon Mobil

To give an idea of the size of Saudi Aramco, we'll compare it to Exxon Mobil (NYSE:XOM), which has a market cap of $311 billion as I write.

On the production side, Exxon Mobil supplied about 4 million barrels a day to the market in December 2015, while in the same month Aramco produced about 10.25 million barrels.

Where Aramco really shines is in regard to reserves, where it now has control over a little over 260 billion barrels. Exxon Mobil reported it had approximately 14 billion barrels of oil at the end of 2014.

It's not hard to figure out the value of the reserves held by Aramco. If oil dropped to $30 per barrel, it would still value the reserves at $8 trillion. Bump it up to a fairly modest $40 per barrel, and the value of its reserves soar to $10 trillion.

Some have thrown around the idea the market cap of the company, if it were to list itself, would probably surpass the trillion mark for the first time for a publicly traded company. That's very possible and likely, but it's probably not going to be as high as some may think.

Listing considerations

Some of the thoughts being bantered around by the royal family has been to possibly list the stock first on the Saudi stock market, and from there maybe list it on other exchanges later on.

The problem there is the Tadawul (Saudi stock market) only has a total capitalization of approximately $345 billion. It's highly questionable it could deal with even a small percentage of the company.

On the other hand, if it lists on more liquid exchanges, it would have to reveal more of its inner workings, which it hasn't been willing or needed to do in the past. If its listing doesn't result in more liquidity for the company, it's questionable as to why it would take any action in the first place.

In The Economist interview, Muhammad bin Salman said the thinking is to start in Riyadh. He said a ruling on the matter would probably come sometime in the next several months.

One major change it would make in the company and country

There is one thing to consider with this that is extremely important to investors, and that is how Aramco would be dealt with by the royal family in regard to the use of funds if it goes public.

In the past it has dispersed it to the family, public works projects, and to its people in the form of energy subsidies and other things. I don't see how it could continue to do that if it is a publicly traded company.

For that reason, a big part of what is being weighed concerning a decision is if it's worth the increase in equity and relief of strain on its budget, in exchange for loss of control on some of its spending. This is probably why it wants to list in Riyadh first, in order to maintain more control.

Investors would want to see the company start to spend more on things that would increase its value, which could raise some serious conflicts of interest; especially if it lists outside of the country.

Oil price outlook confirmation

I don't see this as a panic move by Saudi Arabia, but it does point to the fact it must take steps in the next two or three years to deal with a prolonged low-price oil environment.

It is already cutting projects and subsidies, while looking to diversify its economy, because of its huge budget deficit, which ran just under $100 billion in 2015. Revenue is projected to fall another $25 billion in 2016, with an estimated $13 billion more in spending cuts being planned.

As investors, I think this is extremely important to take into account when analyzing the price of oil. I've been saying for some time we shouldn't listen to what is being said concerning Saudi Arabia, but watch what it actually implements or puts into action. The fact it's looking at a variety of tools to use to ease pressure on its budget and spending, means it knows it won't recover the type of revenue it enjoyed in the past. That means its outlook for the price of oil remains on the low side. I agree with that assessment.

Until something gives on the production and supply side, the price of oil will at best remain subdued and level, and at worst, drop into the 20s, and possibly a little lower if a significant amount is added to the market, which is expected in 2016.

Demand has also been lower than expected recently, and that adds further fuel to the oil price fire.

Conclusion

I don't think there's any doubt Saudi Aramco would become the first publicly listed trillion dollar company in history if it decides to go public (I understand when measured in today's dollars, there probably have already been some valued at that level in the past).

From purely an investor's perspective, this is interesting. With the price of oil this low, and likely to drop more, combined with the possibility a listing could happen when the prices are down even further, this is a play that could reap enormous rewards over the long term. Even if the price of oil remains close to where it is now, this would be a tremendous opportunity because the price of oil will eventually rebound, although not near to the $100 per barrel level enjoyed in the recent past.

There is also the question, beyond the price movement of the stock, how the company would reward investors. Would it initiate a dividend? Would it spend more on exploration and development? The spending is the major issue I would want clarified as an investors, as it's been the piggy bank for the country for a long time, and going public would mean it would have to change some of those practices.

Just as important is the actions being take by Saudi Arabia (even if it doesn't go the IPO route with Aramco) confirm it sees the price of oil being under long-term pressure. That's why it's looking at alternative revenue sources to relieve some of its long-term budget challenges.

I'm not too excited with the Tadawul being the initial exchange the company would be listed on, but if it starts there, I don't see any reason, over time, it won't be expanded to other exchanges. What would really cause a stir is if it lists on more liquid exchanges that would result in more transparency with the company.

-

Permalink Reply by Joseph-Ohio on January 12, 2016 at 3:15am

Permalink Reply by Joseph-Ohio on January 12, 2016 at 3:15am -

So........we (our oil and natural gas industry) are in competition with SA / OPEC in a survival struggle and an IPO emerges from the other side - so what happens if our investors rush to buy into 'the competion's' offering ? ?

That right there reads to me like turning away from our domestic growth and helping 'the competition' to beat us up.

If that would happen where would investor's money end up ?

Free lifestyles (education / health care / housing / funding for our enemies / etc.) for the Socialist / Communist / Despotic Countries and joblessness / no growth for us would seem to me as to how things would pan out.

Time for us (way past time for us) to coalesce and embargo / disallow such investments domestically and / or by our allies if you ask me.

BTW - I don't see SA / OPEC as allied with our best interest myself - are there those here that do ?

JMHOs

-

Permalink Reply by Joseph-Ohio on January 12, 2016 at 3:56am

Permalink Reply by Joseph-Ohio on January 12, 2016 at 3:56am -

Everyone should be on the lookout for 'flying monkey wrenches' as I see an over supply of them as well these days.

-

Permalink Reply by Joseph-Ohio on January 12, 2016 at 4:44am

Permalink Reply by Joseph-Ohio on January 12, 2016 at 4:44am -

http://www.upi.com/Business_News/Energy-Industry/2016/01/11/Hoeven-...

Take the above link (from the API SmartBrief newsletter I just received today) and read what one U.S. Senator has to say about the current state of affairs in the Natural Gas and Oil market.

-

Permalink Reply by Joseph-Ohio on January 13, 2016 at 8:35am

Permalink Reply by Joseph-Ohio on January 13, 2016 at 8:35am -

In spite of my perspectives on it - I guess there are 'degrees of war making' after all.

-

Permalink Reply by Joseph-Ohio on January 21, 2016 at 3:38am

Permalink Reply by Joseph-Ohio on January 21, 2016 at 3:38am -

Does the SA and OPEC behaviour represent an 'existential threat' to the security and well being of our country / economy / way of life / freedoms / living standards ? ?

Based on what I see, hear and read on the news (including these pages) I think they do.

Will our leadership ever see it that way ? ?

Will they ever step up the tempo in answer to their'assault' ? ?

I think escalation from our side of the street is overdue.

JMHOs

-

Permalink Reply by Philip Brutz on January 21, 2016 at 4:05am

Permalink Reply by Philip Brutz on January 21, 2016 at 4:05am -

Is the real cause of the oil glut the decline of China's oil consumption?

-

Permalink Reply by Joseph-Ohio on January 21, 2016 at 4:36am

Permalink Reply by Joseph-Ohio on January 21, 2016 at 4:36am -

I tend to agree that it's a big part of it.

However, I'm also thinking China has access to as much oil and natural gas as they want.

How much do they want ?

How much do they want to use ?

How much do they want to stockpile ?

But, what do we do about the whole can of worms in the meantime ?

Roll up in a ball and let the world kick the snot out of us ?

I'm thinking it's time to coalesce with our vetted allies and build a private economy between us.

Find out who we can trust and work with them and together work against the others who are working against us as we write.

That's not isolationist.

I think it's just being smart.

-

Permalink Reply by Joseph-Ohio on January 21, 2016 at 4:48am

Permalink Reply by Joseph-Ohio on January 21, 2016 at 4:48am -

Forget the NWO - too grandiose / impractical - consolidate and fight back.

Stop aiding and abetting the opposition.

-

Permalink Reply by Joseph-Ohio on January 21, 2016 at 5:08am

Permalink Reply by Joseph-Ohio on January 21, 2016 at 5:08am -

I mean 'what's the plan' ?

Build a library and record the 'legacy' of peace in the Middle East at the expense of our Country's population / standard of living / values / economy / industries / freedoms ?

That wouldn't be a plan that I would welcome / embrace.

For the 1st time since Kuwaite I think we have reasons to defend ourselves and fight a war.

JMHOs

-

Permalink Reply by Philip Brutz on January 21, 2016 at 5:26am

Permalink Reply by Philip Brutz on January 21, 2016 at 5:26am -

Would you sell oil to China?

- ‹ Previous

- 1

- 2

- 3

- Next ›

Top Content

Latest Activity

- Top News

- ·

- Everything

John P replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH

John P replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH Jim Pollock replied to Jim Pollock's discussion 'New well going in on tower road' in the group Columbiana County, OH

Jim Pollock replied to Jim Pollock's discussion 'New well going in on tower road' in the group Columbiana County, OH Andy replied to Jim Pollock's discussion 'New well going in on tower road' in the group Columbiana County, OH

Andy replied to Jim Pollock's discussion 'New well going in on tower road' in the group Columbiana County, OH Jim Pollock replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH

Jim Pollock replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH tacoma7583 replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH

tacoma7583 replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH Jim Pollock replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH

Jim Pollock replied to Jim Pollock's discussion 'Red Rock Energy' in the group Columbiana County, OH

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com