Shell Chemicals is taking steps that suggest it finally may be ready to pull the trigger on a long-debated petrochemical complex which would include an ethylene plant (steam cracker) and three polyethylene units in the heart of the “wet” Marcellus/Utica natural gas liquids production region. If the $3+ billion project advances to construction soon, it would significantly impact ethane market dynamics, not just in Ohio/Pennsylvania/West Virginia but along the Gulf Coast too. And if it turns out we’re in for extended stagnation in drilling and production, the Shell cracker also may undermine plans to build additional NGL pipeline capacity out of the Marcellus/Utica—or any other cracker there. Today we discuss the likelihood of Shell proceeding with its Beaver County, PA cracker and the effects the project’s development might have.

The production of NGLs in the Utica/Marcellus really started taking off in 2011-12, when shale drillers, responding to declining prices for natural gas, began to focus on “wet” gas liquids plays to take advantage of higher prices – thus higher returns. That required the build-out of gas processing and fractionation capacity, which we documented initially in Whoville, the Big New NGL Hub in Marcellus/Utica, and more recently in our Join Together With Demand series and Drill Down Report. As we noted in that report, in 2009, there was only 600 MMcf/d of gas processing capacity in the entire Northeast region, most of it legacy infrastructure dating back decades, and now there is some 7,600 MMcf/d of gas processing capacity—more than 40 new plants built in the past six years, most of them built by MPLX (MarkWest) at eight major processing centers across the region. There are still more gas processing plants on the drawing boards. Similarly, there’s now some 500 Mb/d of fractionation (C3+ or full range) and another 240 Mb/d of de-ethanization capacity. All that production—natural gas, mixed NGLs and “purity” products like ethane, propane, butanes and natural gasoline—has also resulted in the build-out of extensive take-away capacity (pipelines for gas, NGLs and purity products; rail- and barge-loading terminals for NGLs and purity products) as well as the development of local gas-fired power plants to consume Marcellus/Utica gas and—the subject of our blog today—proposals to construct in-region steam crackers to consume locally sourced ethane.

We zeroed in on the NGL/purity products side of things (takeaway pipelines and local cracker projects in particular) in Episode 9 of the Join Together series. There, we discussed four possible crackers in the Marcellus/Utica: 1) a Shell Chemicals project in Potter and Center townships, Beaver County, PA; 2) a Braskem North America/Odebrecht project in Parkersburg, WV; 3) an Appalachian Resins project in Salem Township, Monroe County, OH; and 4) a PTT Global Chemical/Marubeni Corp. project in Allenport, Washington County, PA. Since then, no Final Investment Decision (FID) has been made for any of the four, but in recent months Shell has made moves that strongly suggest it’s close to committing to its project, including the signing of a long-term contract for 76,000 square feet of office space near the project site and the negotiation of right-of-way agreements with nearby landowners for two pipelines that would deliver ethane to the planned cracker.

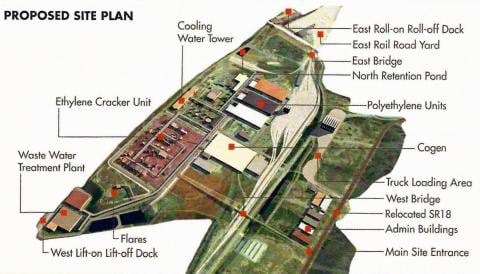

Let’s look at what’s Shell’s been considering: a petrochemical complex (see rendering below) with a cracker that would convert about 90 Mb/d of ethane into ethylene, as well as three polyethylene units that would convert ethylene into about 1.6 million tons of polyethylene a year. The facility would be built at a 780-acre site on the Ohio River (formerly the site of the Horsehead Zinc smelter); its ethane would be supplied by nearby fractionation units and/or de-ethanization units (more on this in a moment).

Figure 1; Source: Shell Chemicals

The polyethylene units (see project-site rendering in Figure 1 above) would produce low-density and linear low-density polyethylene (LDPE and LLDPE) that is used to make a wide variety of every-day products (things like food packaging, film, trash bags, toys and diapers), as well as high-density polyethylene (HDPE) that is used to make crates, drums, bottles, food containers and other types of housewares. In addition to making ethylene, the cracker would generate various byproducts used to make fuels and other chemicals.

Regional Ethane Infrastructure

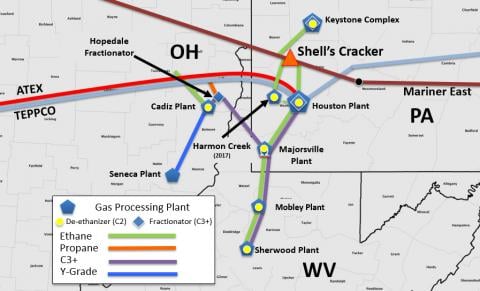

Now let’s consider the Marcellus/Utica ethane infrastructure situation that Shell--and the others considering Marcellus/Utica crackers must integrate into their operations. As we said, midstream developers over the past four years have built an impressive array of fractionators and de-ethanizers, as well as pipelines to keep the production and takeaway of ethane (and other NGLs) in balance. By far the most extensive system in the region is that developed by MPLX (formerly MarkWest) shown in Figure 2. The system includes gas processing plants, fractionators and de-ethanizers linked together by parallel liquids pipelines with gas plant connections into all the regional natural gas pipes. As we described in Join Together With Demand/Ethylene Crackers, the MPLX system includes a distributed de-ethanization network (each processing plant complex gets its very own de-ethanizer) and separate “Ethane Loop” Distribution (the green pipelines in Figure 2) that can transport all extracted ethane to the ETP/Sunoco Mariner pipelines, the Enterprise AETX pipeline and to the Shell plant site – orange triangle). The system works as an extended supply/distribution header designed such that a downstream ethane take-away problem can be “distributed away”. If a downstream outage cuts ethane demand, each processing plant can reject a portion of the ethane necessary to balance the system. Each processing plant can reject just enough ethane to handle the problem without causing an issue with gas take-away pipeline BTU content. (See Back to the Ethane Asylum for more about ethane rejection.) In effect, this system acts similar to storage for handling ethane demand disruptions, which is quite important since there is no ethane storage in the region.

Figure 2; MPLX Ethane System That Would Feed Shell Plant; Source: RBN Energy

Regional Market Conditions

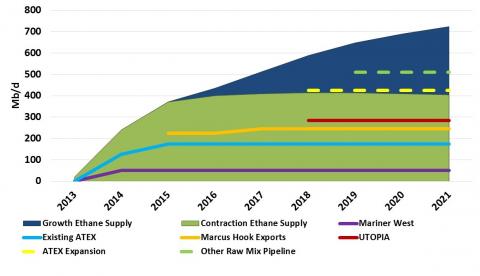

As noted above, production of ethane and other NGLs has been rising at a rapid clip in the Marcellus/Utica for a few years now. (Ethane accounts for about 60% of the typical NGL “barrel” from the region; the ethane percent varies considerably from well to well, and can be as high as 70% and sometimes below 50%.) Future NGL production levels (including production of ethane, the purity-product focus of our attention today) will depend in large part on future hydrocarbon prices. If crude oil prices are high, that will tend to boost NGL prices, encouraging producers to drill for more “wet” gas containing higher quantities of NGLs. If crude prices are low, the converse will be true. Producers will tend to drill for more dry gas, particularly for some of the very large dry gas wells that are being developed in the Marcellus and Utica (see Dry County? Utica Dry Gas Wells Headline). Thus, under RBN’s Growth Scenario (which has crude prices rising to $60/Bbl by 2021), potential ethane supply (both extracted and rejected) in the Northeast would continue climbing, to more than 700 Mb/d five years from now (green-plus-blue shaded areas in Figure 3). However, under RBN’s Contraction Scenario (in which crude oil drops back from current levels and holds at no more than $40/Bbl by 2021), potential ethane supply in the region would stay flat (green shaded area). See Spinning Wheel for more about RBN price scenarios. The take-away here is that there is a wide range of how much ethane that will be available for extraction in the region, depending mainly on the level of crude prices.

There are only three things you can do with the ethane produced in the Marcellus/Utica: 1) move it away by pipeline, 2) “reject” it into locally produced natural gas, thereby increasing the Btu value of the gas, and 3) - if a local cracker gets built- consume it in that local cracker. Option 2 has been the “go-to” choice for most of the region’s ethane the past few years due to poor economics for extracting ethane (worth more selling as gas than transporting and selling as liquid ethane), constrained ethane take-away capacity, and the fact that no local cracker has been constructed. The mostly horizontal lines in Figure 3 (within the green and blue shaded areas) show the cumulative takeaway capacity that’s been built or planned, beginning (at the bottom) with Sunoco Logistics’ 50 Mb/d Mariner West pipeline (purple line), which moves ethane from Houston, PA to Marysville, MI and the Canadian border for supply to Sarnia, ON crackers. Then there’s the 125 Mb/d first phase of Enterprise Products Partners’ Appalachian-to-Texas (ATEX) ethane pipeline to Mont Belvieu, TX (blue line), and Sunoco’s Mariner East pipeline from Houston (PA) to the company’s export terminal at Marcus Hook, PA (orange line; first ethane cargo exported 3/9/16; see Ethane: Boat on the Water!!). These pipelines can move the ethane volume shaded in green below the orange line. In total there is about 225 Mb/d of pipeline takeaway capacity today, although this capacity is not currently running full. In 2016, just over 200 Mb/d will be rejected and sold as natural gas (area over the orange line plus capacity not utilized in existing take-away pipelines due to rejection economics).

Figure 3 Ethane Balance; Source: RBN Energy

With that much rejection in the region, clearly there is enough ethane for Shell’s 90 Mb/d cracker. But Shell is not the only company with designs on that ethane supply. There are several pipeline expansions in the works that could theoretically move all Contraction Scenario ethane out of the region by 2018. The planned projects, are the lines stacking up in Figure 3 in 2017 and beyond:

- Expansion of Mariner East to move more ethane out of Marcus Hook (2016-17 bump-up in orange line)

- The proposed Kinder Morgan Utopia East pipeline from Harrison County (in eastern Ohio) to Fulton County, OH at the Ohio-Michigan border (red line, 50 Mb/d, expandable to 75 Mb/d)

- Expansion of Enterprise’s ATEX pipeline to 265 Mb/d (yellow dashed line)

- Other raw mix pipeline which could be Kinder Morgan’s Utica Marcellus Texas Pipeline (UMTP) project discussed below (green dashed line)

Kinder Morgan’s Utica Marcellus Texas Pipeline (UMTP) project would batch mixed NGLs and ethane and other purity products along a converted—and flow-reversed—Tennessee Gas Pipeline that for years moved natural gas north from the Gulf Coast to Ohio.

Both the ATEX pipeline expansion and the Kinder Morgan UMTP projects haven’t made much progress getting shipper commitments and are a pretty hard sell today. The price of ethane is only 19 cents/gal in Mont Belvieu, and it costs 14.5 cents/gal to transport Marcellus/Utica ethane to Mont Belvieu via the existing ATEX pipeline—and we understand it would cost closer to 18 cents/gal to move it on an ATEX expansion—and there is an additional 5 to 7 c/gal fractionation fee at one end of the pipe or the other. Those economics are about a nickel under water, making it a tough proposition when today’s low ethane prices leave shippers with a negative netback.

But as we said in Spinning Wheel – Prices for Natural Gas Liquids (NGLs) Headed Back Up, the price for ethane on the Gulf Coast is expected to increase significantly when all the new ethane-only crackers and the Enterprise Morgan’s Point ethane export facility are fully on-line.

So here’s the bottom line. If crude prices are high, it is likely that there will be more than enough Marcellus/Utica ethane for Shell’s cracker, a second cracker, and the pipeline projects discussed above. Ethane prices will be higher, not such a good thing for Shell. But the plant is being developed very close to ethane supplies, which will provide a significant feedstock transport cost advantage versus Gulf Coast crackers. On the other hand, if crude oil prices are low it is likely that there will not be enough ethane to go around for Shell, another cracker and all those pipeline projects. Most likely Shell would be able to secure long-term contract supplies for their facility, leaving most of the pipeline projects high and dry.

The impact extends far beyond the Marcellus/Utica region. Those ethane barrels used by the Shell cracker will not be moving by pipeline to the Gulf Coast, which will further tighten that market as new ethane-only crackers and the Enterprise ethane export dock come on line.

It will be some time before we know how all this shakes out. But for beleaguered producers suffering with low NGL prices and big-time ethane rejection, the possibility of tight markets, buyers fighting over their barrels and higher ethane prices sounds pretty good.

The Pittsburgh Business Times hosted an event yesterday in Beaver County, PA–the place where Shell is spending money to explore whether or not to build an ethane cracker plant. Seems like we’ve been writing about Shell’s potential ethane cracker forever. We’ve chronicled just about every up and down. We’ve also highlighted various initiatives they’ve undertaken since announcing Monaca, PA as their chosen site–something they did back in March 2012, now four years ago (see

The Pittsburgh Business Times hosted an event yesterday in Beaver County, PA–the place where Shell is spending money to explore whether or not to build an ethane cracker plant. Seems like we’ve been writing about Shell’s potential ethane cracker forever. We’ve chronicled just about every up and down. We’ve also highlighted various initiatives they’ve undertaken since announcing Monaca, PA as their chosen site–something they did back in March 2012, now four years ago (see