Leasing negotiation ends due to pricing issues.

Just had a lease negotiation end due to pricing issues. Anyone else?

Tags:

Replies to This Discussion

-

Permalink Reply by bo boboski on January 10, 2015 at 12:00am

Permalink Reply by bo boboski on January 10, 2015 at 12:00am -

I agree. All it will take is just a HINT of the Arabs thinking about stop producing any more oil, and it will be going back up. If they actually do; the price of oil will skyrocket. If I had the extra cash, and was a gambler, I'd be buying up oil futures stock NOW!

-

Permalink Reply by Philip Brutz on January 10, 2015 at 4:38am

Permalink Reply by Philip Brutz on January 10, 2015 at 4:38am -

http://seekingalpha.com/article/2798185-the-crash-in-oil-prices-rai...

The Crash In Oil Prices Raises Questions And Opportunities For A Lifetime

Disclosure: The author is long CVX, XOM. (More...)

Summary

- The price of oil has dropped nearly 60% in the last 4 months or so.

- Conflicting information makes this perhaps the most intriguing topic of the decade.

- Along with questions come opportunities.

First things first: Read this article I wrote just about 2 months ago. It has close to 700 comments and 140,000 total hits from around the world. It has so many points of view that I consider this one article to be the best I have ever written (aside from my portfolio articles of course!).

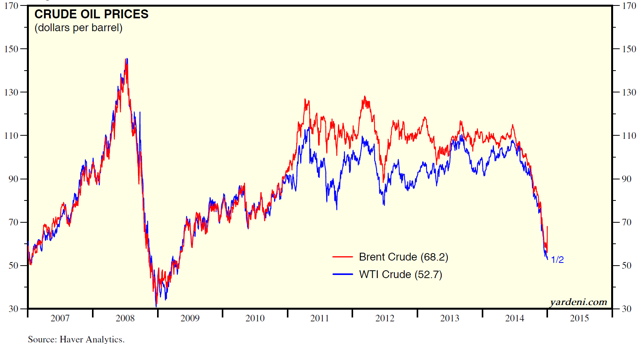

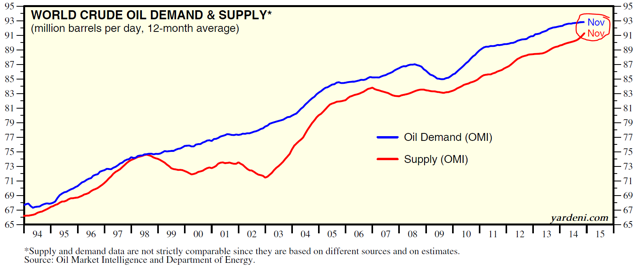

Just the other day, a reader of mine left this link within a comment that illuminates what I am writing about today. The research done by Yardeni has these provocative charts:

The "crash" is obvious.

Are my eyes deceiving me, or is supply still below demand as shown in the chart above. Is Yardeni "lying"? Is the US Department of Energy not giving us the truth? I would seriously doubt that.

My Thesis And Our Potential Opportunity

Let me see if I can be clear in my thesis here. The economic law of supply and demand means that when supply of a product greatly exceeds that of demand, the price of the product declines. If demand increases and supply decreases, the price of the product rises.

As any manufacturing expert will tell us, if demand is weak on a product, they stop production until either the existing supply is significantly reduced, or the demand builds to a point where it makes sense to keep manufacturing the product.

Stay with me here.

Now, in the case of oil, we have been bombarded with the news that there is asupply glut that has been unmatched in the history of mankind. At the same time, the largest manufacturers are increasing production even though those same news reports that are screaming "glut" is also screaming reduced demand.

This simply does not make sense in any of the economics courses I have ever taken, whether beginner or advanced. Ergo, I believe something else is going on that mere mortal investors are simply not privy to and have to guess at.

Let's Take A Look At Just A Few Conflicting Occurrences In The Oil Patch

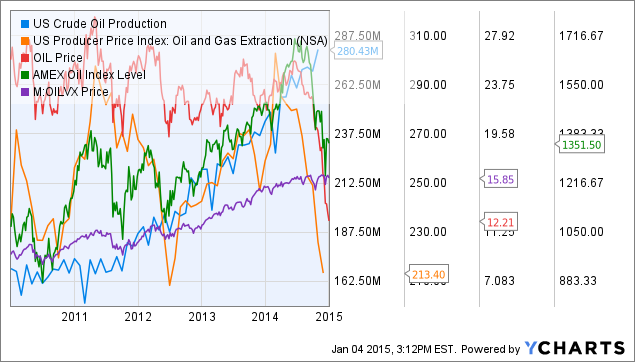

US Crude Oil Production data by YCharts

Just looking at this simple chart shows (look closely) that production of US oil has rapidly increased, and according to news reports, increased production is scheduled for 2015 as well. The prices of just about every other oil metric has collapsed rather suddenly as you can see.

Now, I have heard and read about all of the reports that the US is playing a game of "chicken" with some foreign countries, like Russia, Iran, Venezuela and even some OPEC nations, but these nations have no plans on cutting production, and are actually increasing supply.

To me it looks as though the US is rattling the oil saber as a show of force, and that it has no desire to stop becoming an energy self sufficient nation. I love that actually, because it is about time that we take charge of our own energy needs and call the shots for not only us, but perhaps the rest of the world.

However, why would the two largest energy companies on the planet; Exxon Mobil (NYSE:XOM) and Chevron (NYSE:CVX) continue to produce product if it loses money on every drop? It simply does not make sense since both of these companies can quite easily use their vast resources to grow other portions of their businesses rather than throwing good money after bad, right?

I am old enough to remember when OPEC had the US by the "proverbials" back in the mid-1970's and intentionally kept a lid on oil production (the "embargo") just so the price would increase, and as "punishment" against the US for its participation in the 6-day Yom Kippur War.

As Wikipedia explains it:

OPEC started the embargo in response to American involvement in the 1973 Yom Kippur War. Six days after Egypt and Syria launched a surprise military campaign against Israel to regain territories lost in the June 1967Six-Day War, the US supplied Israel with arms. In response to this, OPEC announced an oil embargo against Canada, Japan, The Netherlands, theUnited Kingdom and the US.

That is the reason we have the strategic oil reserve supply in the first place! So we are not held hostage to nations who hold a "hammer", in case of an emergency.

As a matter of fact, it was not that long ago that the President authorized a massive release of millions of barrels of oil from that reserve to offset extremely high prices.

These historical issues are factual and can be found just by doing an Internet search folks, I am not that smart to make this stuff up.

Questions Lead To Once-In-A-Lifetime Opportunities Sometimes

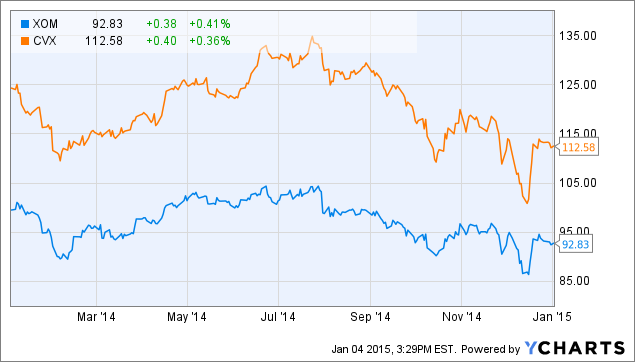

Just take a look at the share prices of XOM and CVX:

Both companies have staged a bit of a rebound even as prices of oil have continued to decline. The high point for CVX and XOM were reached just this past August. CVX hit roughly $135.00/share and XOM hit about $105.00/share.

The current price of CVX reflects a 20% drop from its high point and the current price of XOM reflects a 15% drop from its high point.

I smell money. More than that, I smell income now and more in the future!

The current dividend yields on each of these mega cap blue chip dividend aristocrats are more than compelling. Over the long term, the income received could secure your entire financial future.

- XOM: 2.95% yield, $2.76 per share is the current annual dividend amount.

- CVX: 4.12% yield, $4.28 per share is the current annual dividend amount

- Both of these companies have paid and increased dividends for more than 25 consecutive years.

I believe, that given the conflicting reports on what has been going on in the oil patch, investors should buy each of these enormous companies' shares and hang on for life.

I Could Be Wrong Of Course

Nothing is risk free, and there is no free lunch. While I believe my thesis will turn out to be correct, there will be consequences if these companies begin losing money and the share prices tank. Anything is possible so please do not take these opinions as slam dunk ideas to place all of your eggs in one basket.

If I am correct, well, let's see what happens.

The Bottom Line

Oil, all of it, will be used at some point and perhaps we are witnessing the"REAL peak oil" phenomenon. If I am correct, we will stand to gain in BOTH income and capital appreciation, sooner than later.

Both of these stocks should be bought on the dips and held in my opinion.

Disclaimer: The opinions of the author are not recommendations to either buy or sell any security. Please remember to do your own research prior to making any investment decision.

-

Permalink Reply by Nancy LeNau on January 10, 2015 at 3:34pm

Permalink Reply by Nancy LeNau on January 10, 2015 at 3:34pm -

Thank you Philip Brutz for this Wonderful Article ! God Bless you, Nancy LeNau

-

Permalink Reply by RB on January 17, 2015 at 1:07pm

Permalink Reply by RB on January 17, 2015 at 1:07pm -

It is very interesting to say the least. I had these very same thoughts: "This simply does not make sense in any of the economics courses I have ever taken, whether beginner or advanced. Ergo, I believe something else is going on that mere mortal investors are simply not privy to and have to guess at."

There must have been a huge supply backlog, but also challenged is the supposed inelastic nature of oil, due to alternatives provided by fracking. And I believe the current strategies reveal the huge markup we have been paying for in oil. Otherwise, if it cost so much to produce, they would absolutely quit producing until supply caught up with demand. Instead, they went the Walmart strategy; sell more with less markup.

If you remember, back when these gas prices started with their weekly increases, maybe early 2000s, the oil firms said $5.00 gallon would be a deal if they didn't get their right to drill offshore. Kind of a blackmail statement, but it was said. And then there were the supposed refinery issues that caused the price increase. All a bluff to justify price increases, because, they really were unjustified.

As far as the fracking firms, why should they quit. They had to know, again economics 101, that entering the industry would increase supply and in turn decrease pricing. Isn't that what this is all about? That should have been a first factor in deciding to venture into the industry. I could never understand why prices were remaining so high.

In reality, perhaps supply, demand, cost of goods sold and pricing are all now catching up.

-

Permalink Reply by Dexter Green on January 18, 2015 at 7:05am

Permalink Reply by Dexter Green on January 18, 2015 at 7:05am -

Global demand collapsed. That was not foreseen as a possibility. China is slowing down. Europe is about a week away from being in flames. The Saudis are really, really pissed at the Russians and want to crush their economy. Everybody hates Iran. This sort of geopolitical meltdown is not something that was baked into the price. The bloodbath will continue for some time. People who are unleashed and expecting a sharp rebound need to learn to be patient. This is not a short term event.

-

Permalink Reply by Kyle Nuttall on January 16, 2015 at 9:53am

Permalink Reply by Kyle Nuttall on January 16, 2015 at 9:53am -

I spoke with an Antero in-house landman today. He said that his team had been cut by about 2/3, but that it was still bigger than it was when he started in 2011. Just some perspective.

I've gotten calls today from potential clients who are being approached by landmen about new leases from Stone Energy in Wetzel, and Noble Energy in Gilmer (Gilmer!!!) County. Things are slowing, but aren't stopping. Hang in there. If you can wait for the bonus money, it might be wise to do so.

Keep in mind that there are two major pipeline construction projects and the Parkersburg cracker plant which will all be finished in about 2018. All three will demand gargantuan amounts of gas. Wells being drilled now will not supply that demand.

-

Permalink Reply by Adam Martin on January 17, 2015 at 4:50am

-

Drilling in the Marcellus / Utica region will continue with very little interruption. Antero is repositioning their CAPEX budget from Drilling and Land acquisition to Drilling only. They have enough acreage right now to drill for the next 20 years. Was talking to a contract construction manger, building well pads for Antero, and he said they have over 700 well pad loctions in their plans. Imagine 2 to 8 wells per pad and you are looking at 1400 to 5600 wells to be drilled. Most companies will look to drill in locations where the infrastructer is already developed, drilling more wells on already completed well pads or even exploring other strata from alrady existing well pads. As Kyle mentioned above, many pipeline, cracker and LNG projects are in developement so this oversupply of nat gas will level off. No to mention the talk of Nat Gas only power plants that are being built all over the US. The larger, fiscally responsible companies will aquire those who are burdended with debt and the circle of life will continue in the gas patch.

-

Permalink Reply by Dexter Green on January 18, 2015 at 7:07am

Permalink Reply by Dexter Green on January 18, 2015 at 7:07am -

I wouldn't count on things continuing uninterrupted. NGL prices have collapsed. Oil is dead money. Appalachian differentials for nat gas are obliterating balance sheets. Only the core of the core areas will see development until there's some sense of where the market is headed.

-

Permalink Reply by Kyle Nuttall on January 19, 2015 at 1:22pm

Permalink Reply by Kyle Nuttall on January 19, 2015 at 1:22pm -

The sense I get is that smart money would be betting on an over/under of about a year for prices to recover and leasing to start back up. Is that the sense you're getting?

-

Permalink Reply by Dexter Green on January 19, 2015 at 3:40pm

Permalink Reply by Dexter Green on January 19, 2015 at 3:40pm -

The macro picture looks more grim. I'm hoping that we're in a different place a year from now.

-

Permalink Reply by Douglas on January 9, 2015 at 9:31am

Permalink Reply by Douglas on January 9, 2015 at 9:31am -

Per news report in WV Antero just let go all there land men in WV

-

Permalink Reply by Keith Butcher on January 9, 2015 at 11:42am

-

I'm still looking to lease....so let me know what you have and we'll go from there

- ‹ Previous

- 1

- 2

- 3

- 4

- Next ›

Top Content

Latest Activity

© 2025 Created by Keith Mauck (Site Publisher).

Powered by

![]()

| h2 | h2 | h2 |

|---|---|---|

AboutWhat makes this site so great? Well, I think it's the fact that, quite frankly, we all have a lot at stake in this thing they call shale. But beyond that, this site is made up of individuals who have worked hard for that little yard we call home. Or, that farm on which blood, sweat and tears have fallen. [ Read More ] |

Links |

Copyright © 2017 GoMarcellusShale.com